Who Is Loaning Money for Mortgage At These Low Interest Rates?

While this historically low interest rates (I saw 30yr fixed interest rates fell below 4% within the past couple of weeks) are amazing for those of us with mortgages, I have wondered who in the world is loaning this cheap money. As an investor just witnessing the housing bubble collapse and all the press over foreclosures and falling home values I would think any investors would require higher interest rates for the additional perceived risk. However mortgage interest rates have done just the opposite, and fallen to all time lows.

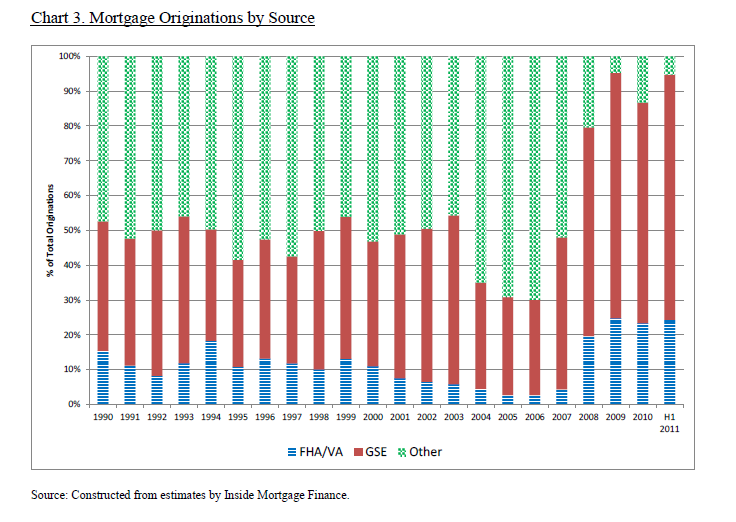

My suspicion has been at least that the US government has been underwriting or buying nearly all US mortgages originated in the past couple of years. After all when I refinanced last year I soon found that Fannie Mae had assumed ownership of the mortgage while Everhome continued to service the loan. It was the 1st time (that Im aware at least) that the US government actually owned one of my loans.

doctorhousingubble.com just posted a chart on mortgage originations that I think validates my suspicions.

This shows a very sharp increase in the percentage in mortgage originations by US government agencies in the past couple of years.

I recognize this is one of the ways the US government is trying to help boost the economy, but it feels a little weird knowing that the economics of my household budget are "managed" by the government. While I can see the short term direct benefits to me, I don't know how to quantify the long term implications (if any) of this management by our government. I wonder if it will actually prolong the depressed housing market since I suspect its supporting artificial demand in the housing market and preventing housing prices from finding a true bottom.

Related in Real Estate:

No Closing Cost Loan Example (Nov 29, 2012) I've gotten multiple requests to clarify the recent no closing cost refinance loan I just completed. Its a bit of a vague term and could be done different ways, but the end result is that there are no out of...

3.5% 30 Year Fixed No Closing Cost Refinance (Nov 27, 2012) We finally closed this week on our 3.5% 30 year fixed refinance with no closing costs (no closing costs = a credit from lender/broker large enough to offset refinance costs). It took us over 2 months (67 days from initial...

Appraisal Appeal Unsuccessful (Nov 05, 2012) Not much of a surprise, the appraiser dug in and didn't budge after we submitted our appraisal appeal: Our more favorable comparables were based on county property records. Interestingly the appraiser indicated the MLS data is generally considered more accurate...

Comments (4)

Wow! I'm in the middle of a refi on my primary mortgage --- 3.875% 30 years. My lender has told me that BOA is the investor so I'll be making my payment to them. Not sure if BOA is being subsidized by the Feds or not???

Posted by In Debt | October 11, 2011 10:58 PM

Don't forget that interest rates are subject to supply and demand just like everything else. Right now there is extremely low demand for houses (and therefore mortgages) due to the state of the economy. One of the ways banks make money is by making loans. If they want to continue making loans in this environment then they have to offer low rates to entice people to get a loan (buy a house). Government subsidies may be lowering rates artificially, but I believe they would be nearly as low without the subsidies due to the demand situation.

Either that, or maybe the banks just wouldn't give any loans, or give less loans, without government subsidies? That would raise rates (supply reduction), but given that there aren't many other ways for banks to make money in this economy, I would think they would need to still try and make loans. Thoughts?

FYI - Just refinanced to 20 years @ 3.75%, down from 25 years left on old mortgage @ 5.125%. It feels great!

Posted by Paul | October 12, 2011 10:12 AM

Government's been underwriting housing for decades. Who in their right mind would loan someone money for a house with only 20% down and a fixed rate over 30 years? Prior to Fannie Mae's founding in the 30's, no one really wrote these mortgages. It wasn't until the federal government started underwriting these things that the long-term fixed rate mortgage took off.

Posted by Jason Clark | October 14, 2011 2:19 PM

Do you have a chart that shows actual dollars being lent? I know the "percentage" has gone up but what if total dollars has gone way down. I don't really think this chart shows the full info.

Posted by Eric | October 23, 2011 2:56 PM