Triple Your College Savings in Less Than a Month

Even if money is a little tight these days we are still ready to pounce on an great opportunity when we find one. How often do you get to double or triple your money in under a month?

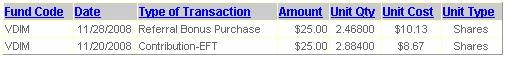

The Ohio 529 Plan is offering a $25 Referral Bonus for new accounts. You can open up an account, name a beneficiary for that account, deposit $25 in a Vanguard index fund, then get a $25 match in the account in about 10days. Rinse and repeat with another beneficiary. A little legwork to fill the forms out to open the accounts, but you get to double your money - something everyone will value these days.

You can even triple your money starting with the 2nd account you open. Open your first account (using a referral code such as this one:2439370) to double your $25 initial deposit. To turn $25 into $75 just refer your partner to open an account and your partner will get a $25 bonus and you will get a $25 bonus. Then your partner can refer you on a new account and you can turn $25 into $50 and your partner will also get a $25 bonus.

Even though our baby hasn't arrived yet we are taking advantage of this offer. I am opening accounts and listing a different family member as the beneficiary to each account (myself, my wife, my mom, my dad, etc) and will change the beneficiaries to our baby once she/he has arrived! In the meantime we get to double or triple the money we are setting aside for college.

How hard is it to change the beneficiary?

There is a form on the collegeadvantage web site that you can print off and fill our to change the beneficiary. The form requires a signature guarantee, but if you process a bunch of these forms/accounts at once, its just one headache for all the accounts you want to consolidate.

How to Open An Account with a referral code:

1) Enroll online or via postal mail. The entire enrollment process only takes about 15-20 minutes the 1st time. Make sure you have birth date/SSN for the beneficiary.

2) Enter your personal information. The application asks for your SSN, Drivers License, mother's maiden name, etc as the account owner. You will also need to identify the beneficiary of the account and provide his/her SSN and birthdate (You can be the beneficiary of the account if desired).

3) You'll then choose an initial investment contribution ($25 is the minimum). There is a Vanguard 500 Index Option (V500) or about 25 other investment options. Enter your bank information for ACH withdraw for your initial deposit and then make sure you enter a referral bonus code such as 2439370 to get your $25 referral bonus.

4) The last parts of the application will offer to setup recurring deposits, identify a successor owner, and some demographic information. None are needed to get your bonus.

5) It will take roughly 10 business days to see your contribution and bonus appear in your new account.

How to Maximize This Deal Step By Step:

1) Open your first account with the above instructions.

2) Now refer your partner to open a new account using the instructions above, but have your partner enter your account number as the referral code.

3) Now you open a 2nd account with a different beneficiary but enter your partners account number in as the referral code. You will get a $25 bonus and your partner will get a $25 bonus.

4) You can rinse and repeat for as many beneficiaries as you can name accounts for.

Other Notes:

- You can still take advantage of this offer even if you already have an Ohio 529 plan. You just have to name a different beneficiary to the account to take advantage of the deal. For instance if you already have an account with you as the owner and daughter's name/SSN for beneficiary, you can't create a new account with your daughter as the beneficiary, but you could create an account and name yourself as the beneficiary.

- The investment options are attractive to me- plenty of Vanguard low cost index funds to choose from.

- If you don't live in Ohio should you still do this? Yes I live in NC and am still taking advantage - you only miss out on your state income tax breaks but not putting money into your own state 529 plan. Small change compared to doubling or tripling your money.

- My goal was to put aside $5,000 for college savings when my child was born. I thought I was not going to be able to achieve that, but if I really try and take advantage of this offer - in theory I would only need $1,675 to get $5,000 in college savings a much more achievable number for us at this point.

Related in Free Money:

Kashi Settlement Up to $27.50 Back (Oct 18, 2015) If you have purchased any Kashi products between May 3, 2008 and September 4, 2015 you may be eligible for a class action lawsuit settlement. You can fill out a claim form at allnaturalsettlement.com even if you don't have any...

Free EPIX HD Online Trial till March 6 (Dec 20, 2014) EPIX is offering a free trial until March 6 for their online movie streaming subscription. No credit card or existing cable account required to signup. I've signed up and used my account on an Android tablet and Chromecast. Per...

Free Weekend Car Rental (Mar 26, 2013) Here is an offer that sounds great if your looking for something exciting to do for an upcoming weekend. Why not grab a free rental car for the weekend and get out of dodge? Mr. Pickles has documented a recent...

Comments (11)

What an ass! I hope they catch you and shut you down. No wonder our economy is in the shitter, when every other person is trying to game the system. A before you dismiss me as being somehow 'below' you either in intelligence or social standing, consider that you don't know me. Instead think about the merit of my words. That money comes from somewhere.

Posted by Robert | February 26, 2009 10:11 AM

Robert, Thanks for the comment. I guess this is gaming the system a bit, but I am not sure whats wrong with that - I am taking advantage of the offer - maximizing its benefit. Its like buying something when its on sale - next you will tell me its wrong to buy something on sale AND use a store coupon to maximize the savings because the company would lose money.

Posted by 2million | February 26, 2009 11:40 AM

Please tell us you are not dreaming up ~560 "family" members for this...also, who did you contract out the back door repair to? I asked, never saw an answer. Thanks.

Posted by Anonymous | February 26, 2009 5:40 PM

This money comes from somewhere - Ohio taxpayers most likely - and if you are using this benefit multiple times, you are ultimately going to prevent someone else from using it. It is clearly an unintended loophole, and it just doesn't pass the moral test...

Posted by Octopus | February 26, 2009 9:57 PM

Another vote for not doing this. It would be bad enough if you actually lived in Ohio. But instead you have the gall to take their taxpayer money while living in North Carolina. Just hope Karma doesn't get you or you'll soon have two unemployed people in your household...

Posted by Anonymous | February 27, 2009 12:51 AM

Personally, I wouldn't create a ton of accounts for this kind of deal. First of all, if the money is never used by your kid, then you have to name another beneficiary - you don't get the money back...at least, that's how 529s work in Texas. There are other reasons I'm not such a fan of this method you have here, but they're mostly moral.

I think others will take advantage of this opportunity you've talked about, but I have to agree with Octopus that it was an unintended loophole and taking advantage of it is actually going to hurt Ohio. That money comes from the state budget, which is raised by taxes, so while you're getting free money, taking advantage of it the way you're doing is punishing the residents of Ohio. I'm all for getting great deals, but this one isn't really that great in my book.

Posted by Kristy @ Master Your Card | February 27, 2009 1:27 AM

Hmm - maybe I jumped the gun a bit on this one. I would be frustrated if I was an Ohio taxpayer and people started doing this. I have only opened a couple accounts so far - I might leave it at that.

Anon- I just used a local handy man whom I had previously used on other projects. You always need a good handyman that doesn't rip you off. Espically with 4 properties to maintain.

Posted by 2million | March 1, 2009 11:27 AM

I think this is great. It's NOT immoral to take advantage of a loophole, but it IS your responsibility to give your baby every advantage.

It's not as if you won't have to put in a lot of work for that money. It will take 67 different beneficiaries to reach the $5,000 goal, right? It'll be a commitment to do the consolidation!

Posted by Christine | March 1, 2009 6:32 PM

I don't think it's any different from opening a bank account in order to get a bonus. In each case, the bonus is built into program costs.

Posted by Steve | March 2, 2009 7:25 PM

Steve, they estimate before they do this a certain level of participation. They budget for it. If that is abused then their budget will be thrown out of whack, at a time when states are really hurting.

Christine, the fact that this is 'work' doesn't mean a damn thing. Thieves work hard too, they just don't *produce* anything. And that's how we got to this place - look how much of the nation's income is not based on producing anything at all...

Posted by Karen Eliot | March 18, 2009 12:15 PM

Kristy- 529 is just the name of the IRS tax code that allows for tax free withdrawals of the earnings. You can always take the money back out of the 529. The Participant, or what you might think of as the "custodian" is the owner of the account. You just may have to pay taxes and penalties on any earnings that are withdrawn if not used for qualified education expenses for the beneficiary.

Posted by Booger | March 27, 2009 5:42 PM