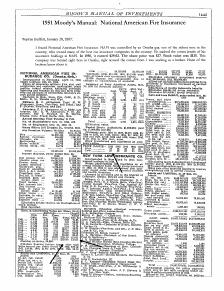

Example of An Investment at Fire Sale Price

If only we could find investments these days like this one Warren Buffet found with NAFI back in 1951. With so much financial information at everyone's fingertips today I think it makes opportunities like this a thing of the past - or at least the easy ones.

Earnings Per Share $29.02, Book value (liquidation value) per share $135.83 and the company's shares were trading around $23.50-$25 per share. I'm drooling....

Also Berkshire Hathaway Inc released Warren Buffet's 2009 Annual Letter to Shareholders recently. As always, a very valuable read from a very wise investor.

Related in Stocks:

Chairmen Letters to Shareholders (Mar 09, 2014) Its that time of year again --the close of fiscal years means an overload of annual reports including Letters to Shareholders. Two annual letters that I read each year are those from Berkshire Hathaway (Warren Buffet) and Fairfax Financial (Prem...

Investment Performance January 2014 (-2.94%) (Feb 23, 2014) January 2014 Investment Report: January Highlights: January was a bad way to start out the year, but our portfolio performed slightly better thank our benchmark (-2.94% vs -3.17%). We made our regular monthly investments in our Roth IRAs, and some...

Investment Performance December 2013 (+2.20%) (Jan 10, 2014) December 2013 Investment Report: December Highlights: December was another subpar for us as our portfolio performed poorly compared to our benchmark (+2.20% vs +2.58%). We made our regular monthly investments in our Roth IRAs, and some dividends & dividend reinvestments....

Comments (0)