June 2010 Monthly Cash Flow

Last month I posted our May cash flow analysis and given how tight things are these days with our downshifting to a single income and starting a family, feel that we probably need to pay closer attention to our cash flow at least in the near term.

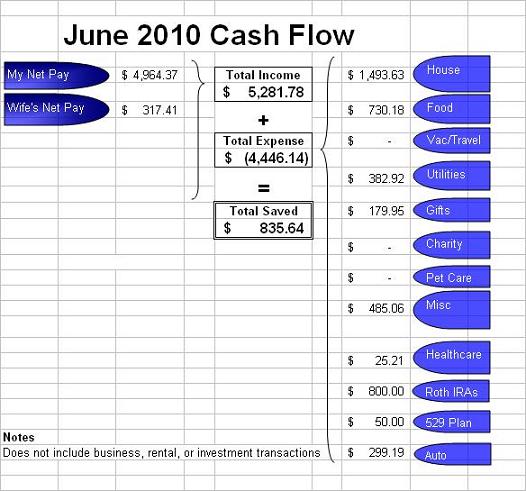

So here an update with our June 2010 cash flow:

Here is our monthly update:

- Income - Fairly steady with my wife's take home dropping to a more typical amount for the month. May's income was about twice what my wife normally brings home.

- Food - It definitely looks like we need to pay closer attention to our food bills. My wife and I have made significant changes after she stopped working - mainly we limited eating out to 4 or less times a month along with focusing on utilizing coupons or specials to keep our average restaurant bill down to $15-$20 for the two of us. However, that being said clearly we need to pay closer attention to our grocery budget as that is where the bulk of our spending is. Maybe we can set a budget of $400/month for groceries and see if that helps us reel this in. I believe we can get this down to <$600/mo on a regular basis.

- Utilities were up slightly as we went on an equal payment plan for gas heat this past year and had to pay off the remaining balance.

- Gifts - were up for the month as I had to rent a tuxedo for a friend's wedding and decide to categorize that as a gift.

- Misc - We continue our management of major purchases via monthly cash flow. Last month our major purchase was a cruise/vacation for my wife and I. Our major purchases for June included some patio furniture at Target my wife grabbed at 75% off (~$160); an Xbox360 media extender (~$136); and upgrades to our media center (~$100).

Related in Cash Flow:

August 2014 Cash Flow (Sep 05, 2014) Well its been nearly 2 years since I sat down and did a scrub of our monthly cash flow. I use to do this regularly w/ MS Money, but now I find it painful to do. Its a lot more...

November 2012 Cash Flow (Dec 03, 2012) Its been 2 years since I last showed a snapshot of our monthly cash flow. I've realized some things have changed with our growing family and over the past couple years I've put a focus on improving our cash flow...

Reducing Financial Impacts of a Job Loss (Jan 26, 2012) My wife was recently notified that the preschool she teaches at for a few hours a week is shutting down. It got us thinking about a more difficult scenario for us - the loss of my job. Given its by...

Comments (3)

Yes, you probably could do better with the food. I don't try very hard to save on the food budget (which also includes paper goods, cleaning supplies; anything from the grocery store) and don't mess with coupons or comparison shopping, and spent $471 last month for 6 people. We don't eat out and do cook almost everything from scratch. And we're vegetarians, which I understand helps, although vege-meat is about $5 a can... good luck with it!

Posted by Anne | July 5, 2010 2:25 PM

Went through your past cash flow postings to see if this was asked previously. I wasn't able to find anything.

You stated that you are leaving out investment/rental income. Your balance sheet says that you have 2 rental properties. Would be good to see gross rental income against all investment real estate cash expenditures. Unless your properties as a whole were cash flow positive, taking into account all investment property cash income and expenditures, it would seem like the cash flow you present should include this.

The investment portfolio is less problematic because the NW shift each month is due largely to the unrealized gains/losses from mark to market in your relatively large portfolio. Not worried about that b/c that is not cash.

Investment property taxes, maintenance, repairs, accounting, legal, insurance, license fees, and other operating expenses net of tax benefits should be accounted for.

Posted by ETFnerd | July 13, 2010 9:07 AM

ETFnerd,

Good idea - I'll add that to my todo list. The rentals are cash flow positive though, especially since the mortgage on Rental #2 is no next to nothing. Also fyi, here is the best breakdown I have posted so far on the rental investment return.

Posted by 2million | July 16, 2010 1:26 PM