July 2010 Monthly Cash Flow

I have started posting our monthly cash flow analysis given how tight things are these days with our downshifting to a single income and starting a family. I believe we need to continue to pay closer attention to our cash flow while we get through this tight period of our journey to financial freedom.

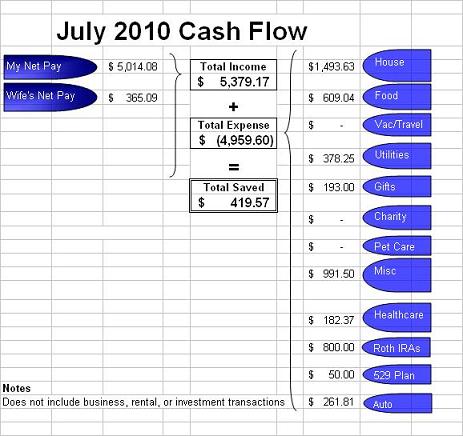

So here an update with our July 2010 cash flow:

Here is our monthly update:

- Income - Fairly steady with my wife's take a typical amount for the month. She works a couple hours a week tutoring and at other kid focused businesses.

- Food - Continues to improve as we pay closer attention to our food expenses.

- Gifts - were up for the month as we bought a couple wedding gifts.

- Misc - We continue our management of major purchases via monthly cash flow. Our major purchase for July was a new IKEA dresser to replace one that was falling apart from college ($~334).

- Our Misc expenses were also up as we started the process to refinance our primary residence to take advantage of lower rates. We had an appraisal done on House #4 for $390 - the results the house appraised for $320k - yeah!

- Looking at our cash flow analysis really stresses to me how tight things are. We are trending between $400-$800/mo left over for savings/investments/debt repayment/etc at the end of the month. I'd say we would be living paycheck to paycheck if it wasn't for the additional cash generated from our current investments, rental properties and side business activities. Things otherwise would be too close for comfort.

- EnoughWealth posted a nice cash flow comparison.

Related in Cash Flow:

August 2014 Cash Flow (Sep 05, 2014) Well its been nearly 2 years since I sat down and did a scrub of our monthly cash flow. I use to do this regularly w/ MS Money, but now I find it painful to do. Its a lot more...

November 2012 Cash Flow (Dec 03, 2012) Its been 2 years since I last showed a snapshot of our monthly cash flow. I've realized some things have changed with our growing family and over the past couple years I've put a focus on improving our cash flow...

Reducing Financial Impacts of a Job Loss (Jan 26, 2012) My wife was recently notified that the preschool she teaches at for a few hours a week is shutting down. It got us thinking about a more difficult scenario for us - the loss of my job. Given its by...

Comments (2)

Hi 2Million,

I was recently reading about the tremendous net worth disparity between whites and non-whites and came across your blog. I really enjoyed it. Undoubtedly, your family will reach your goal of 2 million.

Interestingly, your family reminds me a lot of my parents. They immigrated to the US with about $200, and we bought and sold multiple homes and my dad (an engineer) meticulously tracked his wealth for much of his life. They heavily sacrificed their material happiness to support me and my sister.

Now that they are retired, they have a high net worth, are "financially free" and don't have to worry about money.

The only caveat is that a life of meticulously tracking his net worth I think really harmed my Dad. He still values his time very low. He will drive several miles to find cheaper gas. He still has a difficult time pulling the trigger to buy things such as an HDTV signal for his tv, etc..

In reading about the psychology of happiness, I think it is important to splurge every once in a while, and happily destroy your net worth graph at critical and frequent times in your life. I don't think my dad has the capability of doing this. I think people need to physically plan a decrease in net worth, as harmful as that is to the end goal at multiple points along the journey.

I am a surgeon married to a cardiologist and we fortunately also don't worry about money too much, but have a much more difficult stress, which is a tremendous demand on our time. But Im sure you will agree that our net worth can not provide us anything that beats what our children can provide in terms of happiness.

Anyway, best wishes to you! Your advice about managing money is tremendously beneficial to many people.. -Steve

Posted by Steven Chu | August 17, 2010 11:57 AM

Can you post a link to a copy of the template you use for your monthly cash flow statement?

Posted by Ken | October 14, 2010 4:20 PM