August 2010 Monthly Cash Flow

I have started posting our monthly cash flow analysis given how tight things are these days with our downshifting to a single income and starting a family. I believe we need to continue to pay closer attention to our cash flow while we get through this tight period of our journey to financial freedom.

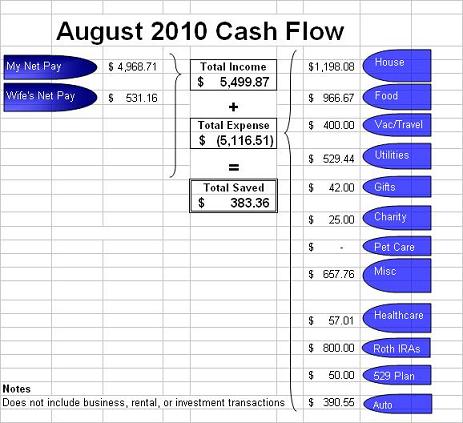

So here an update with our August 2010 cash flow:

Here is our monthly update:

- Income - Fairly steady with my wife's take slightly higher than avg. for the month. She works a couple hours a week tutoring and at other kid focused businesses.

- Our mortgage expense was lower this month since we refinanced and did not need to make a mortgage payment. This month expenses includes just the accrued interest on the paid off mortgage and prepaid interest at the refinance closing.

- Food - Wow what a disappointment after we felt we were getting things under control in July. Talking through with my wife we think about ~$200 of this is bedroom decor my wife bought at Super Target and ended up getting classified as groceries. However that still means we spent $700+ on food/dining and that is still well above my ~$500 target.

- Gifts - finally a slower month.

- Charity - Made an additional one time donation to Americares' Pakistan Flooding Relief Fund.

- Misc - We continue our management of major purchases via monthly cash flow. Our major purchases for August were ~$200 in bedroom decor (curtains + comforter), a beach condo rental for $400, and a wireless router for our home ($90) - our cheap router from China was no longer cutting it.

- Things are still uncomfortably tight - if we had to make our normal mortgage payment this month we would have only had <$100 left this month.

Related in Cash Flow:

August 2014 Cash Flow (Sep 05, 2014) Well its been nearly 2 years since I sat down and did a scrub of our monthly cash flow. I use to do this regularly w/ MS Money, but now I find it painful to do. Its a lot more...

November 2012 Cash Flow (Dec 03, 2012) Its been 2 years since I last showed a snapshot of our monthly cash flow. I've realized some things have changed with our growing family and over the past couple years I've put a focus on improving our cash flow...

Reducing Financial Impacts of a Job Loss (Jan 26, 2012) My wife was recently notified that the preschool she teaches at for a few hours a week is shutting down. It got us thinking about a more difficult scenario for us - the loss of my job. Given its by...

Comments (8)

Hi 2 M - From reading your blog, you are very thrifty. Can you comment on how much additional average annual expenses have increased and how much you have estimated going forward?

I know there are sites out there with this info but would like to hear your real world experience.

Posted by Bob | September 23, 2010 1:54 PM

I have been amazed the past two months about your comments on food and your desire to have a monthly total around $500. We have a family of four including a 5 and 7 year old. We have a strong focus on eating organic, heart healthy foods.

grocery store $900

Sam's club $25

fresh fish $90

dining out $420

monthly total $1435 (more than our mortgage!)

Posted by Jennifer | September 23, 2010 2:08 PM

I thought you made over 6 figures a year in salary? If so, how is it that your net monthly take-home is only $4900? Is this because a lot of your salary goes to your 401K? I calculate that your net after tax take-home should be at least over $6000 per month.

Posted by Steve | September 24, 2010 5:25 PM

Bob - Good suggestion. I'll see if I can add that to a future post.

Jennifer - Wow - thats sounds like a lot of money for food, but everybody's different. We are pretty much forgoing eating out these days spend around $150 month on eating out including my work lunches. Otherwise I think we can get our grocery bill down to ~$350-$400 through coupons, buying onsale, growing our own food, etc.

Steve - I do make in that range. I do max out my 401k contributions. However I also do have some other deductions that come out of my paycheck as well including charitable donations, disability insurance, health insurance (for whole family), and health flexible spending account. All of these items whittle my income down very quickly.

Posted by 2million | September 26, 2010 9:19 AM

Nice work with the cash flow. Do you contribute to IRA on top of Roth IRA? May be something to consider.

BTW, I am impressed by your contribution to Pakistan flood. We are a generous nation. Pakistan army/govmt is playing a double game with us. With several billion dedicated to the military when its people are suffering. I never felt like giving a penny.

Posted by finnews | September 26, 2010 3:27 PM

finnews, I contribute to a SEP IRA, but not a traditional IRA - I opt to max out my individual IRA contribution in a Roth.

Posted by 2million | September 26, 2010 5:18 PM

2million, so your take-home salary is $4968. Is this amount AFTER your 401K is deducted out?

Second, how much do you pay in health insurance for you and your family?

Thanks.

Posted by Steve | September 28, 2010 5:52 PM

Steve - yup all those payroll deductions come out before the net pay/take home I have shared above.

Our health insurance alone is currently $382/mo.

Posted by 2million | September 28, 2010 7:16 PM