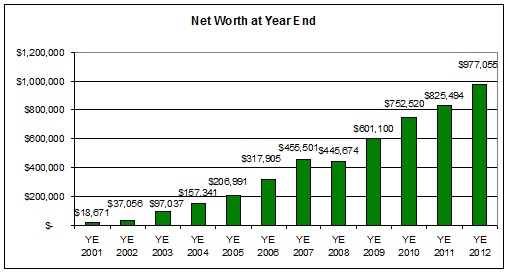

2012 Net Worth Growth

Well with the books closed we officially had a solid year in terms of net worth growth in 2012:

Its hard to complain with double digit portfolio returns. I think its interesting that our annual growth has been very consistent over the past few years where in 2009, 2010, and 2012 we basically grew our net worth by $150k each yr. What I find exciting here is that the portfolio rate of return we had was less each year (that sounds weird doesn't it?). I see it and I think about the effect our growing net worth on our annual earnings capability -- we are earning the same amount, but need less return from our investment portfolio and therefore less investment risk to get those annual earnings. That is a pretty cool thing.

Now if I could only get the markets to return double digit gains consistently - we'd already be financially free if that were the case.

Related in Net Worth:

July 2018 Net Worth Update (+$52,101) (Aug 03, 2018) Highlights for JulyI come out of July feeling optimistic all the way around. We had positive developments on numerous fronts including the bottom line.In July we purchased our 5th rental property! The property market is very hot around our...

June 2018 Net Worth Update (+$22,779) (Jul 08, 2018) Highlights for JuneIn June our activity picked up a bit and we closed with another solid month in the books.Our largest individual stock holding (Genworth) had a breakout month as the US govt (CFUIS) approved the deal for it...

May 2018 Net Worth Update ($20,481) (Jul 04, 2018) Highlights for MayIn May we closed on some long term financing (5.375% 30 yr fixed) for our rentals that we used to pay off our equity line and reloaded our cash for the next acquisition. Ive started looking for...

Comments (4)

Congrats! and your blog inspired me to save a lot more. Compounding in action.

Posted by uk | January 15, 2013 2:55 AM

To what extent has the rental property affected your net worth growth? Do you think these returns are possible by investing solely in the market?

Posted by SR | January 16, 2013 9:25 AM

Hi, congrats on your achievements. One question regarding title of rental properties? Do you feel absolutely necessary to hold rental in LLc or similar?

Thanks

Posted by Bill | January 19, 2013 12:37 AM

SR - I don't think the rentals are critical for net worth growth. I see the rentals more critical to support our cash flow once we are financially free. You need income and generally I would rely on the market to provide that once I'm financially free.

Bill - I don't currently hold my rentals in an LLC, but that is because in years past I didn't think we had that much to protect.....its probably time for me to start thinking about this again though given our net worth growth.

Posted by 2million | January 5, 2014 10:49 AM