QE: The Good and the Not So Good

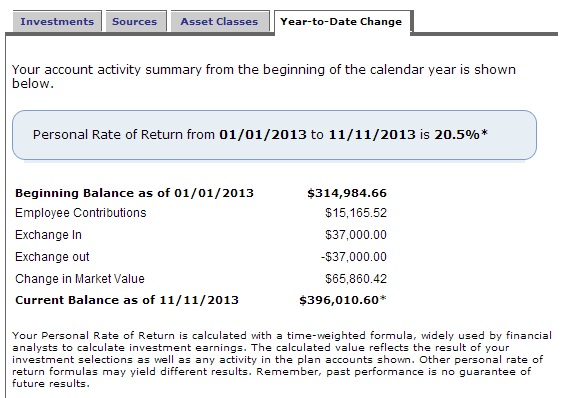

Here is a snapshot I took of my 401k YTD returns and my personal reflections:

The Good:

Holy Cow! That is amazing. Not only have we had a huge upswing in US stock indexes, my entire 401k portfolio is up 20.5% for the year. That includes all the other assets classes like bonds/cash that are pulling down our performance. My 401k has gained over $65k this year - that is more than my annual salary when I started working full time at my employer!

Makes me think about how close I may actually be to the financial freedom line. My 401k is growing at a clip greater than my expenses this year. It is a good year, but will it last? Even if it grows at 1/2 this rate when you combine it with the rest of our accounts/assets (IRAs, taxable brokerages, rentals) etc its still would cover our expenses. Growing at least 1/2 this rate seems possible while the economy is looking better - doesn't it?

The Not So Good:

Stock fundamentals appear to be less of a concern to investors. I want to invest my money where I can see it earn a 10% return or greater for the risk I'm taking. Generally price/earnings ratios continue to climb, now averaging 15-17+? On the surface that means buying with a projected <7% return assuming no growth (I tend to be pessimistic on valuing growth in general).

At some point earnings have to sharply increase or those ratios will come back down. I continue to shift more assets out of stocks over time because there is no way this can last; is there?

My view is this could go one of 2 ways. 1) We are in the midst of a 20yr+ stagflation period where governments will continue to inject as much capital as they can to get us out, but we will teeter back and forth for years to come as debt levels continue to improve. 2) Quantitative Easing will ultimately work and inject enough capital that our economy will begin to expand on its own. This will lead to inflation being a bigger problem that will erode spending power in at least certain areas. I don't know of a great way to protect our spending power from inflation, the only play I know is to hold stocks, real estate, minimize cash/bonds and hope for the best.

I'm no expert, but I'm still worried things are not as healthy as they appear.

Related in 401(k):

2012 401k Contribution Limit (Jan 09, 2012) The 401k employee contribution limit has finally had its first increase in 4 years in 2012. I historically max out my 401(k) contributions so I'll need to tweak my contribution levels to ensure I hit the max by the end...

T Rowe Price Annual Service Fee for Low Balances To Increase (Jul 12, 2011) We got a notice that there are some upcoming account changes to my wife's IRA accounts at T Rowe Price. The main change that affects us is that they are now imposing a $20 annual service fee for accounts with...

$50 Bonus on a ING Direct IRA Account (Feb 02, 2011) ING Direct is offering a $50 sign up bonus when you open an IRA (Roth or Traditional) savings or CD account and deposit $200 by February 7th. Not sure how great an idea it is to invest your IRA contributions...

Comments (9)

Yup, I'm running at 20+% return for the 12 month period ending Oct 31. It's fun to watch the stocks go up and up early in my career, knowing that there will probably be a correction in the middle of my career at my highest earning potential. Can't wait for those stocks to go on sale. It's been a fun ride since 2008!

Posted by Spencer | November 12, 2013 11:53 PM

The entire stock market is up 23% in 2013, so your return seems to be in line with the performance of the market in general. It seems right to be cautious and/or lock in your gains in certain stocks. What to do if you locked in said gains is another quandary altogether....

Posted by jeff | November 13, 2013 12:12 PM

You are pretty diversified already. If you are 100% sure inflation is coming soon then buying more real assets is the right move.

With that said people have been talking about inflation coming for 3-4 years now and if they would have made that move they would have missed out on these gains. I personally want to lock in my gains on stocks that I deem overvalued at this point, but I also dont want to pay CA tax along with Fed tax on em : (.

Posted by shane | November 13, 2013 11:17 PM

Do you mind posting your 401k portfolio. I may have to mimic yours... Sadly my YTD is 6.5%.

Posted by Fellow IBMer | November 14, 2013 4:59 PM

Remember you invest for the long-term, not for what the market will look like in 6-months, 1-year, 2-years. When I buys stocks and mutual funds, I care about where they'll be in 15-years, 20-years. It's an emotion I have had to battle as well. You just can't time the market. You invest regularly, like you have been doing, when the market is up or down.

Posted by Ryan | November 15, 2013 3:37 PM

Fellow IBMer, While I wouldn't suggest you replicate it, here is my current asset allocation in my 401k. Note I shifted funds from the small-cap IDX + total stock IDX to the interest income fund over the past couple months.

Current 401k Allocation:

28.44% TOTAL STOCK MKT IDX

26.24% INTL STOCK MKT IDX

23.89% SMALL-CAP VALUE IDX

15.98% INTEREST INCOME FUND

4.61% PACIFIC STOCK IDX

0.83% REIT IDX

Ryan, Good reminder on market timing. Perhaps the biggest reason I'm focused on this is I am very overweight in stocks. I leveraged up when the market was low and now am gearing myself of for more significant rebalancing. There aren't really any more good options so its hard to move assets to cash or other areas when the market has been doing so well.

Posted by 2million | November 15, 2013 7:52 PM

Congrats on all your success. I'm about to hit the 500k net worth mark and you serve as great motivation as what is to come for me and my family.

I would be interested in your thoughts on Dave Ramsey and I. General your thoughts on primary mortgage payoff.

Thanks

Posted by Nate | November 16, 2013 6:41 PM

Nate, My thoughts on primary mortgage payoff (and just my thoughts) - you can see in my archives I have not yet put a focus on primary mortgage payoff. I concentrate our cash flow on the highest yielding/lowest risk investments. That could be our primary mortgage, but hasn't been yet. I've focused on paying down higher yielding debt like our rental property mortgages or bonds with higher yields (and additional risk). At some point our primary mortgage may become a focus, but at this point I am thinking I'll hit our financial freedom mark with a significant primary mortgage balance. The money is just too cheap not too -- I gotta believe I can find attractive risk/reward investments that will return greater than the

Posted by 2million | November 16, 2013 8:27 PM

Congrats on your progress. I am an ex-ibmer who still has my 401k. Just curious, why don't you hold IBM stock in your 401k?. Seems like a great place to let it compound for years.

Posted by Adam | December 17, 2013 8:09 AM