Profiting from S&P 500 changes

I remember reading about a stock trading strategy that involved changes in the S&P500. I can't remember the details, but the idea was one of simple supply and demand. Any stocks that were added to the S&P 500 stock index where in sharp demand because all passive S&P 500 stock index funds would automatically add them to their portfolio regardless of cost. Likewise S&P 5OO index fund managers would be forced to sell stocks that were removed from the S&P 500 regardless of what price they could get for the shares. The main take away I had was that stocks that were removed from the S&P 500 were oversold and that given time and all other things the same, the stock price would eventually rise to its true value.

To me the idea is a sound one although others don't see an indexing affect on stock prices. It makes sense because the amount of money currently in S&P 500 index fund is estimated at over $1 trillion. However its not as quite as easy as it sounds, just because the S&P500 index officially changes on December 1st, I don't believe the index fund managers have to immediately follow suit, however it makes sense that they would need change their holding within relatively close time of the official change.

I stumbled upon an announcement last night about a s&P 500 change. Basically it states that Genworth Financial will replace Calpine on the S&P500 list on Thursday December 1st.

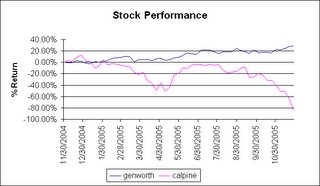

Looking at the historical charts of these two stock price - they are mirror opposites of each other.

Note: Historical data was pulled from Yahoo!Finance

Note: Historical data was pulled from Yahoo!FinanceGenworth has had a steady increase in price over the past year, while Calpine has steadily lost value.

The closing price Tuesday before the announcements were:

Calpine Corp. (CPN) - $0.54

Genworth Financial (GNW) - $34.00

I did a little homework and found out that on Nov 18th, GE announced they were would divest of their 27% ownership of Genworth by the end of 2006. It will be interesting to see what degree this will offset the buying of the stock for index funds.

Calpine is a different story. This company is currently struggling to manage liquidity and growth in its power generation business. It also lost its CEO and CFO on Tuesday, most likely somehow related to this S&P500 change.

I don't plan on investing in either of these stocks, but I would like to use this as a learning experience to see how the stock price is affected by the massive buying/selling that is forced onto S&P500 index funds. I think I will run a small simulation (ie paper trading) as if I was really investing and see what how the investment would work out.

Since GE is going to be selling huge amounts of stock and I am unsure of how this supply will affect the demand for the stock for index funds I will stay away from this stock. However Calpine seems to have potential, its stock price is depressed due to many things including the resignations of the CEO and CFO. It will be further depressed from the sell off from index funds.

My plan would be to buy this stock in 15 days 12/15/2005 (enough time that I think a lot index funds will have sold off their shares) and then hold onto it for 6mos. I am picking 6 months arbitrarily, but I figure that is long enough for any supply/demand imbalance to equalize. I will plan on buying (paper trade) around $1,000 worth of shares, rounded to the nearly even lot size, and then sell them on or around June 15, 2006.

It will be an interesting exercise that will help me keep closer track of these stocks and how their stock price responds to the enormous buying and selling. I may post periodically on how the simulation is going when I observe anything I think is noteworthy.

Related in General:

Save Money on Overhead Garage Storage (Aug 28, 2012) With the upcoming expansion of our family, my wife and I have been discussing the space in our home. While we have a good size home (~2,600 sq ft), its currently laid out with 3 bedrooms and 1 bonus room...

When is a SmartPhone the Right Financial Decision? (May 14, 2012) I last purchased a typical cell phone back in October 2008 with a 2 year contract when we returned from China. My old cell phone broke while we were on assignment in China and I needed something once we...

Black Friday Shopping Highlights (Nov 27, 2011) I have little interest in going out and standing in long lines to pick up a few deals on Black Friday. However we did pick up a few deals over the weekend mostly online: $159 GE Front Loading Washer @...

Comments (8)

DATE: 10:28 AM

I made alot of money over the last year buying and selling Calpine, but i dont trust it anymore, the company is pretty screwed, plus there are usually more commisson charges for anystock under $1.00. Just my 2 cents:)

Posted by SLOMONEY | September 10, 2006 3:05 PM

DATE: 11:57 AM

Another statistic that may or may not lend credence to your theory of supply/demand based on index stocks would be to watch closely the volume traded on the market. I would suppose that between Dec 1 and Dec 15 you would expect a spike in the volume if you are onto something here.

Posted by JaredAllen | September 10, 2006 3:05 PM

DATE: 1:10 PM

Good point on the trading volume. I will also try and keep tabs on it over the course of my exercise. Maybe the volume trend would help me better estimate the duration of any imbalance in the stock price.

Posted by 2million | September 10, 2006 3:05 PM

DATE: 3:03 PM

I remember looking into this a while back when they were adding I think etrade to the index. I've concluded that at the time of the anouncement of the addition of a company to the index the stock price already had the upside factor in. I think (I could be wrong) the companies that do hold funds that mimics the index are warned a long time before of the changes and have already taken the necessary steps to prevent a rise in the price of the stocks from effecting them. They probably just bought the shares, which can be the reason why "gnw" has been rising this past year.

Posted by http://www.financenstuff.blogspot.com | September 10, 2006 3:05 PM

DATE: 4:27 PM

I think it will be a miracle if Calpine doesn't declare bankruptcy. Which means you wouldn't get your 38 cents a share back with the amount of debt they have. Just my guesstimation, however.

Posted by Chrees | September 10, 2006 3:05 PM

DATE: 4:42 PM

Maybe it would have been better to short Calpine on Nov 30th, than buy on 12/15. We will have to see.If they declare Chapter 11 (which is looking likely) they could very well restructure the debt and come out smelling like a rose - what about PCG - didn't they file for Chapter 11? I may be well off though....

Posted by 2million | September 10, 2006 3:05 PM

DATE: 2:29 PM

Update on Calpine being delisted from NYSE. This will further depress shares. Good or bad I don't know, however shorting the shares on 11/30 when I found out Calpine was going to be dropped from the S&P500 would have been a very profitable move.

Posted by 2million | September 10, 2006 3:05 PM

DATE: 3:33 PM

Ok I made a phantom buy of Calpine CPNL.PK for $.273/share. We will see were it goes.

Posted by 2million | September 10, 2006 3:05 PM