Guide to Taking Advantage of 0% Balance Transfer Offers

Based on requests from visitors, I have decided to compile my own guide to taking advantage of the credit card companies' 0% Balance Transfer Offers. I hope this guide will help everyone understand how to maximize the value of these offers and help boost your earnings for the year. If anyone has additional suggestions or tips - please post them in the comments.

What is a 0% Balance Transfer offer?

Most of us frequently get these annoying solicitation from credit card companies trying to get me to sign up for their credit card. Infact there are probably some in the advertising on this web site right now. Most of these offers include some gimmick or promotion to entice you to sign up for these offers.

A typical offer I see is "0% APR on Balance Transfers until 2007!" where the date given is typically 8-12 months in the future. Also, keep in mind the longer the balance transfer offer lasts the more you can make. I typically wait until I receive an offer that is at least 0% APR for 12 months. This is a 0% Balance Transfer offer - read on to find out how you can take advantage of them.

Here is an example of a credit card 0% Balance Transfer offer:

How do you screen out the less attractive offers?

Once you have a 0% Balance Transfer credit card offer, you need to review the fine print to make sure there are not any catches with the offer. The biggest catch out there in a small "balance transfer fee" typically 3% (but varies with each credit card company).

You want to make sure there are no balance transfer fees other fees associated with taking out a balance transfer. (Note: You can still profit if some of these fees are in the offer, but since these offers are frequent, I would just recommend waiting for a better offer).

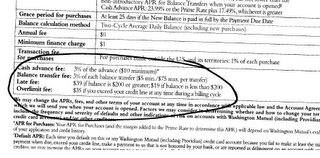

Here is an example of the fine print on balance transfer fees.

Notice this offer has a balance transfer fee of 3% ($5 minimum, $75 maximum). I prefer offers with no balance transfer fees at all, however if you can't find a no fee offer, one with a maximum may also work ok for you (just $75 less profitable in this example).

Now that I have an offer, how do I get access to this 0% balance transfer?

Fill out the application. I usually wait till I get the card in the mail so I know exactly what my limit is. When I call to activate the card, I begin the process of initiating a balance transfer. There are many techniques to choose from:

A) Ask for a check made out to you. I have done this for my Citibank credit cards. When you call to initiate a balance transfer I ask if I can get a check made out to myself. Its that simple. (Note: make sure you wont get a cash advance fee if you do this)

B) Apply the balance to other credit cards.

->B1) If you have a soon to be expiring 0% balance transfer then just ask that the balance transfer be used to pay off the balance on the old account.

->B2) Depending on how much you purchase every month on your credit cards, ask that the balance transfer be applied to you primary credit card to pay off your existing balance and any credit on you primary credit card account you can consume in future purchases. Instead of paying the balance on your primary credit card you spent, earmark those funds as your balance transfer funds.

->B3) If the first 2 options don't work, you can also consider having the balance transfer applied to a unused credit card account. When the transfer is complete you can call the credit card company and ask that a check for the positive balance be sent to you. (Note: I have heard from friends that some companies may not be willing to issue a check for the credit/positive balance so double check before trying)

C) If you have a HELOC have the balance transfer applied to this loan. Then you can write a check to yourself for the amount transferred.

D) If you have any type of loan, consider having the transfer amount paid to that loan. If you are planning on paying down/off the loan in the near future anyway you may be able to make a better rate of return by using the balance transfer to pay it off sooner rather than later.

I have used techniques A, B1, B2, and C all with great success to get access to the balance transfer loan.

Now that I have the 0% balance transfer, what do I do with it?

The whole reason you are doing this is to earn money, so this is a very important step. I always look for the highest-yielding risk free investment.

Here are some suggestions:

A) Online high yield savings accounts such as HSBC Direct, ING Direct, or EmigrantDirect.

B) If you have an outstanding balance on a HELOC or Line of Credit and you can pull back out money at anytime, consider paying down the HELOC or Line of Credit. You may make a better return on your money by saving on the interest payments.

C) Short term treasury bills on TreasuryDirect.gov.

D) Short term CDs such as a 6-month CD.

I have been putting my balance transfers in my EmigrantDirect and HELOC accounts.

How do I pay the balance transfer back?

Every month you should make the minimum payment on this credit card with the balance transfer. The minimum is usually somewhere around 2% of the balance. On a $10,000 balance transfer we are talking about a payment around $200 a month. I usually move the minimum payment amount from my savings account and try to pay the minimum payment as soon as I get the statement to avoid any risk of being late on my payment. To date, I have never been late with one of these payments.

I usually plan on paying back the entire balance of the balance transfer the month before the 0% APR expires. So if the offer expires in June 2006, I would pay the loan off in May to ensure I don't risk accumulating any interest on the loan. You can read the fine print of the credit card offer to determine exactly when the 0% APR expires and when the credit card company begins charging interest.

Other tips on 0% Balance Transfer offers

Taking advantage of these offers does lower your credit score. Its hard to tell how much, but I was surprised last year when my credit score fell significantly most likely due to taking advantage of several 0% offers. I currently have 2 0% balance transfer offers and my credit score appears to have recovered.

-Using balance transfers can help increase your liquidity. Having this "extra" cash in savings accounts with easy access to them, allows me to take my "emergency funds" and other short term savings and put them to work in more restrictive, but better return vehicles, like 1 yr bonds, or paying down some of my mortgage.

-Taking advantage of balance transfer offers can result in pretty significant returns. Last year I probably earned close to $700 in interest from money borrowed using 0% balance transfer offers.

-You typically cannot do a balance transfer from one credit card to another credit card offered by the same company.

-Read and re-read the fine print on the credit card. If you have questions call the credit card company and make sure they explain the fees to you.

Ready to give it a try?

You can start right now by checking out some of the advertisers on this web site. I bet there are a couple 0% Balance Transfer credit card offers on the right hand side of this web page.......

Related in Credit Cards:

Earning $1,000 in Credit Card Promotions (Feb 02, 2014) After a bit of a hiatus in the credit card game, I recently applied for 2 credit card offers each with signup promotions worth $500 in gift cards. For just a few hours of work on my part, I consider...

Capital One Credit Card Offers Auto Pay (Sep 02, 2012) For those of you who use a Capital One card - there is good news. I logged into my Capital One account this week to find they now offer an Auto-Pay feature. This means I can now set up my...

We Just Earned $1,000 For A Few Hours of Work (Apr 23, 2012) My wife and I each recently cashed our $500+ cashback checks from Chase Sapphire for a total of just over $1,000 for opening 2 credit cards and just a few hours of work. In January my wife and I each...

Comments (34)

DATE: 8:35 AM

Thanks for posting the details of your technique.I've always been tempted, but I'm not sure I have the "nads" to do it.Perhaps the next card offer I get in the mail I'll check it out.

Posted by bored | September 10, 2006 3:17 PM

DATE: 9:38 AM

2mill,I plan on doing this in the near future after improving my credit score a little bit. I'm waiting for some things to fall off from the previous year as well as paying down my current 0% offer so that my utilization rate is lower. I've posted about exactly how much money you'd make with such an offer: 1st post and follow-up.As I've noted in my second post, minimums are increasing to 4% and ED has increased their APY to 4.25%. If I transfer the money from ED directly to the CC every month, then I stand to make 3.32% APY.Thanks for the post, very informative as usual.

Posted by franky | September 10, 2006 3:17 PM

DATE: 10:41 AM

I've been following this topic pretty closely for some time now. Spent a lot of time on Fatwallet also. I started the process this week with interesting results. With a shotgun approach with apps this is what has transpired.Citi Platinum Select - $3000Citi Simplicity Rewards - Declined due to to many aps in 6 monthsGM (HSBC) - Approved initially for $1500, asked to do a significant BT and got it bumped to $7000Chase Cash Plus Rewards - $5000Citi Professional - $6000USAA - $25,000.I wonder what USAA was looking at. Now it's time to fix the credit.However, I've already hit my first hurtle. I applied for the highly recommended GM Card from HSBC. Initially, I was approved for $1,500. Not off to a great start. I called and explained that I wanted to do a balance transfer and picked an arbitrary number of $7,000. Underwriting approved it provided I tell them which cards to send the checks to. So, I actually have a balance of $3,500 on an MBNA and $1,200 on an AMEX. I asked they send $4,000 to MBNA and $2,000 to AMEX. I was planning to pay off the balances from savings anyways. But I'm going to request MBNA and AMEX cut me a check for the overpayment. Putting all monies towards paying off the balances, then transfering the $6,800 into an equivalent ING acct.I'm curious as to how other people would play out this situation. What do you recommend? You also made a comment about paying off a HELOC. Have you factored in the "tax deduction" effect? How does the math play out on paying it off (or down) in addition to savings on payments, and interest deductions?Thanks for your blog, huge help.

Posted by Ryan | September 10, 2006 3:17 PM

DATE: 11:02 AM

Ryan,I think I would try the same thing in regards to the GM balance transfer.As far as the HELOC its actually (for me at least) comparable to putting the money in a savings account. For example say my fed/state inc tax rate is 33% and the HELOC and savings account were charging/paying the same rate.With the HELOC I am losing a tax deduction of roughly 33% if I pay it off, but if I stuck the money in a savings account like EmigrantDriect, the interest I earned would be taxed at 33% so the after-tax rates in both cases would be the same.

Posted by 2million | September 10, 2006 3:17 PM

DATE: 5:08 PM

Does anyone know how easy it is to significantly increase your credit limit on new cards? I just got my first 0% card for the purposes of this exercise and was given a $6800 limit (I stated my household income as 85G). When I activated the card I requested an increased limit to 10G which was granted within an hour. Obviously the best way to take full advantage is to get as much money from each card, so I'm wondering if it's just a simple matter of requesting a higher credit limit after you get the card. As hungry as these CC companies are to give out balance transfers it seems like they would be willing to bump your limit 50% without problems. Anyone bump their limits as a matter of course?

Posted by hickory | September 10, 2006 3:17 PM

DATE: 10:23 PM

Have you ever tried making a balance transfer to your debit card? That seems like it would be an easy way of making a transfer. I am thinking of trying that.Thoughts?

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 12:38 AM

For the little money you are making do you really think it is worth the cost of ruining your credit? I konw this would have to affect your credit somehow. Am I wrong?

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 2:06 AM

0% transfers are great! I do them about once every 2 years, and my credit score is well in the 750-800 range. One word of warning, like 2million said read and re-read the fine print! Read the big print too and keep the offers handy in case you ever need to refer back to them.There are also 0% on NEW purchase offers, 0% on balance transfers, and 0% on both. Be wary!I always just transfer over how much I have on my statement and then request a check. It's a great cash advance that doesn't get treated like a cash advance.

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 2:50 AM

I wonder if I could ever get a card like this since I never bought anything on credit (everything cash)

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 3:56 AM

I've noticed that my cards have all eliminated the max limit on cash advances recently, though the % still is 3%. This makes it more expensive to take out big cash advances and needs to be taken into consideration.

Posted by Jojo | September 10, 2006 3:17 PM

DATE: 9:02 AM

This whole discussion is interesting but consider the following:The risk of getting 'caught' unaware by the fine print on one of the credit card agreements, the lowering of your credit score due to opening up unsecured lines of credit (chasing these 0% deals), and the general behavior of living outside of your means (carrying around balances on credit cards in the first place) are worth examining.For example, you transfer a balance to a 0% offer, it lowers your credit score, simply in the applying for a new card. You now go to borrow money for legit purposes (home, student loan), and due to your lower credit score, you are not given the best rates on 'real' debt. This debt is secured and typically longer in term. Where is the interest 'savings' now?My advice is to spend the same amount of energy on adjusting your spending habits that you do on chasing the credit card deals. The 0% offers are the needles, and our overall culture of consumption as a lifestyle is the drug.

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 9:27 AM

Almost without exception, every blogger that advocates the 0% BT game notes the temporary negative impact that it will have on their credit score. If you're about to take out a loan, then this strategy is not for you. But there's a lot of us that simply don't care what our credit score is because we're not in the market for a loan.Second, most of us are leaving the borrowed funds in an extremely liquid instrument like a high-yield savings account. If the CC company changes the promotional terms, then the funds can be returned within MINUTES via an online transaction.Your advice is quite reasonable for the millions of people who misuse their lines of credit. But this strategy is geared toward those of us who are quite savvy when it comes to our finances. The bottom line is that 0% BT's are an extremely safe method of generating interest, provided you follow the rules in the fine print.Crazy Money Blog

Posted by Matthew | September 10, 2006 3:17 PM

DATE: 1:26 PM

Thanks for the post. I am currently planning on taking advantage of a similar offer on a credit card that I recently paid off with a credit limit of $23,700. With ING's promotional interest rates of 4.75% this is a great time to save money in those account. I've used these balance transfers before and they will gladly wire them directly into your checking accout, which I find easier and quicker than having to write a check to myself.

Posted by lpkitten | September 10, 2006 3:17 PM

DATE: 1:26 PM

personnally, I prefer the fixed 1.9% "until paid off" offers better. You can take a decade (or more) to pay it back.

Posted by thetoothfairy | September 10, 2006 3:17 PM

DATE: 11:11 PM

personnally, I prefer the fixed 1.9% "until paid off" offers better. You can take a decade (or more) to pay it back.The below story is based on personal experience with a Chase Visa card and which I have published elsewhere on a few forums in the past. It applies to this discussion if you take these loans to deposit elsewhere and still make charges on the same credit card. --------------------------------------------------------------------------Ever wonder why credit card companies constantly pitch you to consolidate your bills, take a vacation, improve the house, etc. using a cash advance loan at low teaser interest rates? There's a scam behind any offer you get from a credit card company, so beware. They aren't in the business of losing money.These cash advance loans are always touted with low interest rates for some period of time (3.99%, 1.99% or even zero percent). Now, if you pay off all your charges on this account before you take out this loan and DON'T charge anything new until the cash advance loan is paid off, then you will be okay. But of course, most people don't do this. And this is critical: what you may have missed buried in the fine print that I've seen with many credit cards is that if you have an outstanding balance when the cash advance is posted to your account or you make any new charges (in addition to this new loan amount), the payments that you subsequently make against the total owed will be FIRST allocated to the portion of your balance with the LOWEST interest rate.Let's assume you regularly charge $400 monthly on this card and always pay the balance off with each monthly bill. So you never pay any interest to the credit card company. The credit card company is not happy about this, so they bombard you with checks with low interest rates for cash advance loans, hoping to entice you into a consolidation cash advance. Now, due to some unplanned expense, you find you have to take a cash advance of $3200, perhaps offered at some very low annual interest rate (plus transaction fee), to cover that unexpected expense. And let's assume that you'll also keep charging your normal $400 monthly on this SAME card. You'll now need to pay off $3200 extra (in addition to the regular $400 monthly) and you realize this will take you some months to do. Your intention is to keep making your regular payments to pay off your usual monthly bill and add something extra to pay down the cash advance loan over time. You don't think this will be too bad because, after all, you will only be paying 2% interest on the declining balance for the $3200 loan. So you increase your payments to $800 to cover the usual $400 monthly charges and then have the extra $400 applied to reducing the cash advance loan. Right? Wrong!What the credit card company will do is allocate your full $800 payment towards the $3200 cash advance portion first because that portion of your balance has the lowest interest rate. Meanwhile they will charge you full interest (18% or whatever) on the $400 you charge each month (which becomes a growing balance continually exposed to the normal higher interest rates because it is not being paid down). Result: You will pay a lot more interest than you thought by adding the loan at 2% interest and continuing to use the credit card.While this method of allocating payments might seem logically backward to the consumer, it's a system that is very advantageous to the credit card company. Many people get drawn into deals like this and don't realize it until later on, if at all. And unless the government gets involved to protect the consumer from shenanigans like this, it isn't going to change anytime soon.

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 10:36 AM

Very good stuff. As long as you are not applying for big credit in the near future, then it is alright.Also, instead of opening up new CC, you can always just use the offers you get from your current cards, assuming that you have a zero balance.

Posted by Bailey | September 10, 2006 3:17 PM

DATE: 2:24 PM

I have the 1.9% balance transfer. I'm required to purchase at least $25 per month on the card at 8.9%(which I do automatically). I borrowed 10K at 1.9% (which is waaay below the real inflation rate). ...seems $25/month at 8.9% per year is a reasonable price to pay for that loan? (at least until I get tired and decide to pay it off in full)

Posted by thetoothfairy | September 10, 2006 3:17 PM

DATE: 8:30 PM

Is there any way to get the CC company let you know your credit limit before filling in the application with the pre-approved offer? I tryed several times. No result.Thanks!

Posted by crawlspace | September 10, 2006 3:17 PM

DATE: 1:44 PM

I don't know why these credit card companies don't simply give us the interest we earn from their offer. Instead we have to go through this hassle of applying the damn credit card and put that money into a high yield savings account. Or is it because they have a math department on their side that have calculated the odds would be on their side that we would mess up with the new balance?Now that I think about this. It would seem pretty scary if someone got your personal information and use it to make these balance transfer. I wonder if there's a way to prevent someone from opening up new credit cards using your personal information?

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 7:36 PM

Yes I have heard of a service that locks your credit and only lets credit accounts be openend on your credit when you authorize them - or something like that.

Posted by 2million | September 10, 2006 3:17 PM

DATE: 8:38 PM

Dear $2M,Am really enjoying your blog.Also, I'd like to congratulate you on your accomplishments so far.You really do stand far aheado of the pack in terms of net worth accomplishments. Don't rest on your laurels, but do realize you're doing something great.I'm in my late 30s and also in N. Carolina. Married, with children, my situation is a bit different.Not long ago we bought a house and I do remember the very significant difference in rates we would have paid each and EVERY year we keep our mortgage. We were pleasantly suprised when we learned our credit scores were about 40 points higher than we expected. That equates to about a $400 savings per year. A little more than 1/2 of the earnings one might achieve with the zero balance transfer (ZBT)game.ZBT is just another approach to interest rate arbitrage, however, it's one that's complex and fairly risk prone.Somehow I think that there are MANY other ways to earn $700. Perhaps a part time job, perhaps free lancing. I know there are many websites dedicated to free lancing for tech people. Actually, a part time 120 hour project would probably pay $6000 or more. Even after taxes it would be quite a bit more rewarding.I agree with the early poster who recommended rechannelling your energy to finding ways to earn or save money rather than the ZBT approach. I whole heartedly agree.Every time you open up a new card, you create new credit which diminishes the value of your credit line. Also, since the credit is maxed, that's a double negative.Credit scoring formulas look for old, long established credit that's less than 50% utilized. The formulas are prejudiced against new credit as it may predict a pending financial crisis of the applicant.I suppose if I did want to arbitrage interest rates I would like for some form of more easily understood cheap long term debt and a similar high return long term interest based investment. My gut says you'll only find something like that when borrowing against secured assets (like real estate) domestically and investing in foreign debt instruments (which introduce complexities like currency risk). Then again, several of the investment banking firms are offering mixed baskets of currencies in a pre-packaged mutual fund. The idea is that enough currencies (or foreign government bonds depending on the fund) will do well to offset the few that sink.Well, at this point I'm rambling, so I'll wrap up with this thought.At a certain time, maybe not to far from now, you'll have enough money to invest that spending time on ZBT rate arbitrage will not be woth the $700 you might make. Alternatively, additional investment in your career - which might be very time consuming - might also provide a superior reward.Regards,n

Posted by nofcarolina | September 10, 2006 3:17 PM

DATE: 10:35 AM

When you pay (ex.1.9%) for a BT your ultimate profit is reduced further because you are paying with after-tax money. I fully endorse the BT strategies though, and have been utilizing this process since the early 90s when banks would actually pay you up to 2% to use their money interest-free. At that time I maximized the system by completely paying off my fully mortgaged (9%) home in 5 years.I currently have 9 BT offers and 1 HELOC (1.25%) totalling 250k in HSBC making 4.8%.Just wanted to say that the system is definately not for everyone, but if you don't mind reading fine print and paying bills, it does work.

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 3:01 PM

Wow - $250k in oustanding BTs? Do you find it hurts your credit score significantly with so much outstanding?Any additional suggestions to share?

Posted by 2million | September 10, 2006 3:17 PM

DATE: 3:59 PM

Actually 100k is on the HELOC. I really do not keep a close eye on my credit score; it was 756 about 6 months ago. As far as the BT's, I have 16 credit cards and if I don't receive an offer in the mail, I don't hesitate to call and ask. I try to get BT's or promotional cash advances directly deposited to my HSBC account. I use Quicken to help keep track of deadline payments. The best savings came about 3 years ago when I purchased another house with 8 credit card balances, all less than 5%. The savings came from not having to pay mortgage closing costs. After the house closing I immediately applied for a promotional HELOC with no closing costs.One thing to watch-out for:My first promo % HELOC ran out so I paid the loan off and didn't realize I owed $100 for "no balance".OUCH!!I need to invest in a nice magnifying glass.

Posted by Anonymous | September 10, 2006 3:17 PM

Dangerous, dangerous, dangerous. Ever hear of universal default? I am dumbfounded at the amount of risk you are taking for a one-year profit of $700.

Posted by Bryan | March 5, 2007 1:39 PM

I've been doing the zbt's and other credit card games for over 12 years. I've never paid interest and never will. About 6 years ago I signed up for a GM Card that earns 5% with no limit on how much you can accumulated (earn) in one year, the only limit is on redemptions for what kind of vehicle you buy. I earn 5% toward a new vehicle when I charge on the GM card and then transfer the balance onto a 0% card. One other thing I do is pay the zero balance card on the payment due date and pay it off on the day the 0% ends, all electronically. Basically, I keep my money longer. I call the credit card company and ask what that final date is to be sure. Keep good notes and records. Everything talked about above I've known for years and it does work.

Without getting into specifics let's just say I own my house and if I live to be 65 I'll be worth over $5 million....probably more....

Posted by Mikey | March 29, 2007 1:11 AM

I have been in this heavily for 10 years, $700/year ? thats a joke, I make between $14,000 and $18,000 a year now doing this in an online Money market. before that I was saving the same amount in mortage interest by using a heloc instead of a traditional mortgage. All warnings here are valid, never actually spend the money, never use the card after the transfer. ALWAYS have a means to pay off the card at anytime during the promo period, any mistake will bite you, never be late, never miss a payment, and dont do this if you are planning on buying a house,,you can do up it to 3 months before you apply, then stop, pay everything off, your Credit score will be GREAT, get that mortgage, then start investing again, I even deduct all fees on my taxes, My CPA says they are all investment costs, this is completely legit way of making money, I hesitated to post here, because the fewer that know about this the better. Good Luck and read that small print.. Regards Big T

Posted by Big t | April 5, 2007 10:35 AM

some tips: Pay the monthly bills as soon as the statement closing date closes. Open internet access to your account and keep track of closing dates. Then pay the bill the next morning online. This is great on rates like .99% or 1.99%.This will save whats called residual interest, the banks live on residual interest. If you pay by mail, you know what I'm talking about, you send say $500 by mail on say a $5000 balance, the next month you paid interest on $4750 not $4500 like you think, The banks charged you more interest on the previous $5000 balance until you new payment was POSTED. You may think this is not a big deal but it adds up. Also I agree with 2mil who stated he/she pays the entire balance the month before the promo end date, this is good because the residual interest (yes it's on a daily basis) in this case would be the NORMAL purchase rate on the card if the promo date comes and goes. After all your dilligence during the promo period, don't give a dime back to these bloodsuckers you don't have to. Right now I have 9 accounts going totaling $240,000 float, most at 0% some at .99 some at 1.99....It helps to have one or two Huge credit lines,,It happens naturally thru mergers, and then you call them and combine the lines to one card. remember if you pay a small transaction fee, it is per transaction, so on one of my cards I have a $70000 line of credit, it is currently active at 0% and I paid only $75 to have $69,000 transferred directly into by back account for 12 months. (yes some Cards will do that to.) I do see a trend recenty where the normal offer is 3% of the transfer, DO NOT ACCEPT THESE, the good offer will come later on. Best savings is on a mortgage(HELOC), since you save the interest and have no cap gains to declare. If you cant do the Heloc, there are money markets that allow you to write up to 6 checks a month. Capital One is a good one at 5%..You can now get 5.4% with countrywide Savings link online account but no check writing allowed only electronic transfers to your checking acct. They are very quick though, only 1 day to see the amount post in your checking. I am sure there are other things that I do that would be considered good Tips, (and believe me some of them I learned the hard way) so if you have any questions, i would be glad to help out..regards Big T

Posted by Big t | April 5, 2007 6:21 PM

I’m in the very early stages of attempting a BT out of Chase but I actually will be making a purchase @ 0% APR to initially fund an online High Interest CU account (www.rateedge.com (they actually let you charge your initial funding)), so I’ll get both interest at 5.5% (until I move the Balance to my FNBO account) as well as ~24,000 reward points. My main question is can balance limits from Business cards be moved to consumer cards within the same card family?

There has been alot of new activity in my Credit reports within the last two months 2 chase cards were opened, 1 ATT/citicard was opened and 2 Online High Yield Accounts were opened (FNBO & AmTrust). Additionally Chase closed a linked Pier 1 card due to no activity and denied me a credit limit increase on an older Chase card I had. I want to apply for another citi card that is business related mostly for the instant rewards and then move it’s limits to the ATT/Citi card which is 0% BT that starts anytime within the initial 12 month into period. Should I apply for the Citi Business card or wait till there is less activity in the account. I don’t really want to apply once they can see that I’ll have ~24,000 $ of revolving debt (of course simply sitting earning interest) due to the "purchase" at rateedge.com. Advice is needed.

Posted by Eric | June 6, 2007 3:48 PM

Have you ever tried making a balance transfer to your debit card?

Posted by Anonymous | June 8, 2007 11:49 AM

How does this work using your HELOC to save money on your mortgage? I'm curious to know, since we've mastered the high-yield savings float.

Posted by M | June 21, 2007 5:22 PM

Its simple. If you have a HELOC you can pay it down/off with a 0% balance transfer. When the 0% BT expires, you can pay it off with the HELOC. This allows you to carry a portion or all of the HELOC at 0% instead the variable interest rate (ex ~7%).

Posted by 2million | June 21, 2007 8:01 PM

Like "anonymous" has asked twice here, I'm wondering about doing a balance transfer from a debit card account, specifically, my Paypal card, which is treated like a credit card when making purchases. I've been offered a balance transfer at 0%, but the bank won't give me the cash like CitiBank or some others do. In the past, I have transferred from credit card accounts that have no balance, or which have a smaller balance than the transfer I've ordered, and then I'd have the bank send me the overage via a mailed check. However, that is much slower than if I had the funds posted to my Paypal account. I'm scared to do it without confirmation from someone else that it works. I don't want to lose the offer, nor do I want to get hit with a cash advance fee if the issuer recognizes the account as a debit card. [Does the card number identify it as a debit card? Perhaps just listing the issuer as Paypal would give it away since Paypal is not a credit card issuer (though it has some branded cards issued by banks).]

Regarding doing the transfer from a credit card with no balance, 2million's note that some friends have warned that some banks won't send a check for an account credit has me a bit worried since the credit card that I would use if not trying the Paypal card would be one for which I've never tried this (Wash. Mutual). I have to wonder how any bank could not pay off a significant credit. How could it sit on, say, $10,000? Is one supposed to use that in credit card purchases for the next 10 years? It doesn't make sense. I think that, if nothing else, the bank could be compelled--via its own indendent arbitration process or by some government agency--to pay off the credit.

Posted by Scott | October 30, 2007 1:11 AM

I am new to this but wanted to spread a tid bit about how I charge up the 0% cc. The us mint (www.usmint.com) is selling the dollar coins at face value and they ship them to your house for free, you give them a dollar, they give you a dollar, the exchange happens on your zero percent card. I then put the money in my ING account. I have transfered 2500 thus far. I have two zero cc's with a 22,000 limit each. I am workking my way to maxing them out...slowely but surely.

Thanks for all the info and warning, I do take heed to what was said and apply all of the precautions.

Ray

Posted by MrPaseo | September 17, 2008 6:43 AM