Capital One Credit Card Offers Auto Pay

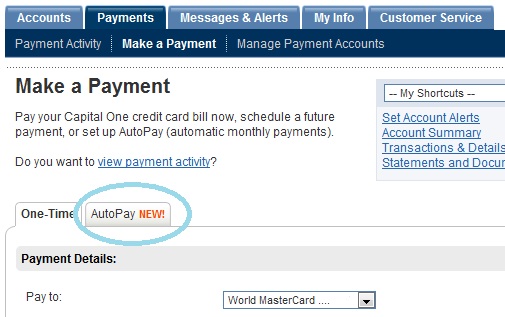

For those of you who use a Capital One card - there is good news. I logged into my Capital One account this week to find they now offer an Auto-Pay feature. This means I can now set up my credit card account to automatically withdraw my monthly balance from my checking account on its due date and not have any risk of late fees and finance charges (as long as there is enough money in my checking account).

This is a far change from when I was growing up. I can remember my parent's near weekly Sunday ritual paying bills and scrutinizing every line item on their credit card bill to ensure there isn't an unexpected charge.

These days in our time poor world I have a bigger fear of paying a bill late than having an unexpected charge. I do scan our credit card bills when they arrive to look for out of place transactions, but do this asynchronously from paying our bills.

My Capital One credit card was the last credit card account I had that didn't offer this auto-pay feature. With this change I now have all our monthly bills on autopay with exception of our electric bill. In our time poor world these days I see this as a critical step to make sure we don't get unnecessarily late fees or finance charges.

Related in Credit Cards:

Earning $1,000 in Credit Card Promotions (Feb 02, 2014) After a bit of a hiatus in the credit card game, I recently applied for 2 credit card offers each with signup promotions worth $500 in gift cards. For just a few hours of work on my part, I consider...

We Just Earned $1,000 For A Few Hours of Work (Apr 23, 2012) My wife and I each recently cashed our $500+ cashback checks from Chase Sapphire for a total of just over $1,000 for opening 2 credit cards and just a few hours of work. In January my wife and I each...

Double Cashback Bonus In Birthday Month on Discover Card (Oct 23, 2011) Here is an easy promotion if you already have a Discover card - sign up to get double cashback bonus for your birthday month. You'll earn 2% Cashback Bonus on up to $500 in purchases from the first day of...

Comments (6)

Auto pay does save time and ensure your bills are paid without late charges. But then I also like to have control of my finances and know exactly what is being paid when. I am still struggling with the concept of auto pay.

Posted by Anne | September 3, 2012 6:50 PM

I use BofA credit cards and I would LOVE it if they would implement this system. This past month for the first time I actually forgot to schedule my payment (I obsessively monitor my account online, but I only have to schedule the payment once a month). To top it off I was out of the country when the payment was supposed to hit so it took me a week to realize it hadn't cleared. Auto-pay for the full amount (rather than what they offer now, an auto payment of a set amount) would have saved me.

Posted by Jonathan | September 3, 2012 10:01 PM

They actually always offered, but you had to fill out a form they would mail you and mail that back in (3 options - Min Payment, Statement Balance, or Full Balance...I think). It was a major pain and a sad grab for late fees. Good to see they are getting with it.

Posted by Matt | September 4, 2012 5:53 PM

AutoPay is great, but the only option is minimum or statement balance which isn't my total balance due for that month. For example, my statement balance is $63 this month but my total balance was over $1000. I wouldn't want to pay only $63 and get charged w/ interests on rest. Is there a way for CapitalOne to let me pay the FULL amount automatically?

Posted by Josh | November 6, 2012 9:23 AM

Be careful with Auto Pay. Your statement cycle ends roughly 27 days before Auto Pay debits the account. For instance, my limit is $3,000. My billing cycle ends on the 20th. The due date for that cycle is the 17th of the next month. This means if I run up a $3,000 charge on the 20th, that bill is not *paid* until after their "grace period". If I spend a single dollar in that duration -- that "grace period" -- I get charged additionally for exceeding my credit limit.

Posted by Evan Carroll | December 12, 2012 1:51 AM

Also be careful to check your account if you have already made a payment. They took out the minimum payment even though I had already paid it last week.

Posted by Scott | January 10, 2013 10:39 AM