Asset Allocation

Back in early 2006 when I reviewed the returns from my net worth in 2005 I realized I needed to spend some time looking at my asset allocation.

Here is what my asset allocation looked like in March:

I took a look at my total asset allocation in March, but dropped the ball and didn't dig any further. Unfortuntely, my asset allocation has already changed enough that I should start over.

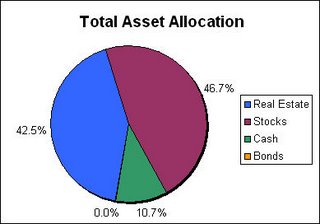

Here is how my Total Asset Allocation looks now:

3 big changes since March:

1) I bought a second property.

2) I vested in my cash balance pension plan, thereby adding bonds (or really bond equivalent investment to the mix). My pension plan earns a yield equivalent to 1 yr treasuries + 1%.

3) I have burned through a sizable amount cash this year.

I actually think my asset allocation is better off today compared to March. I thought I wasn't exposed enough to real estate and given this is total assets (in the case of real estate ignoring the offsetting liabilities) then I think it make sense to have at least 1/2 your total assets in real estate assuming you have corresponding liabilities.

Related in Asset Allocation:

Stock Asset Allocation (Sep 20, 2006) After checking out my total asset allocation, I decided to drill a little further and look at my stock investment allocation. After a poor performance last year, I realized that my stock allocation was almost entirely in large-cap stocks and...

Here is my current asset (Mar 31, 2006) Here is my current asset allocation for all the assets on my balance sheet (just assets; this ignores liabilities). I don't have cars or personal property listed on my balance sheet so it won't show up here either. I suspect...

Comments (5)

http://millionairenowbook.blogspot.com/2006/09/call-to-arms.html

http://millionairenowbook.blogspot.com/2006/09/people-just-have-to-be-right-on.html

Posted by Larry Nusbaum | September 18, 2006 6:57 PM

I think you should break out stocks into US and foreign stocks. they're different enough to justify a separate category.

Posted by empty spaces | September 19, 2006 12:18 AM

I agree that the investment in real estate was a good move but there is one thing that I would worry about is the potential for the value of the investment to decrease if the housing bubble bursts. I've been hearing that there's likely to be a decrease in real estate values accross north america; does this worry you?

Posted by Matt | September 19, 2006 3:06 PM

Hello, i love www.2millionblog.com! Let me in, please :)

Posted by Lusidvicel | December 18, 2006 12:19 PM

I stumbled onto your blog today. It appears as though you doing well to reach your goal and I commend you on that. As an alternative investment and futures broker and a former financial advisor I recommend you discover and investigate additional non corollary assets, particularly managed futures. I do not desire to manage your money. If i can assist in the process let me know. The key benefits are they can potentially increase overall portfolio return and potentially decrease overall portfolio risk.

Todd

Posted by Todd Nagel | December 3, 2010 12:27 PM