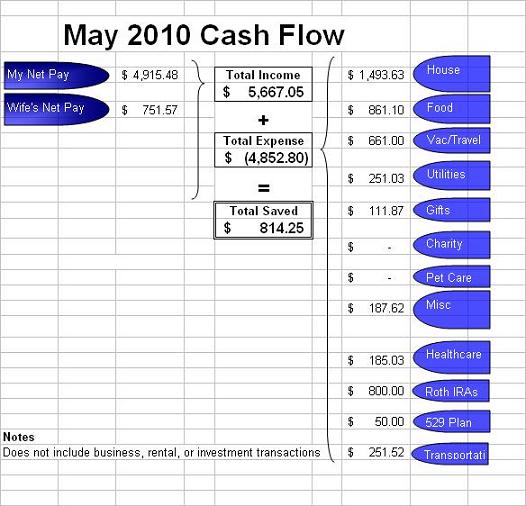

A Snapshot of our Monthly Cash Flow

Back in 2008 I shared a snapshot of our monthly cashflow while we were DINKS on assignment in China. Now that we back in the US, on a single income and our family is bigger, I figure it might be interesting to share a more recent month.

My how things have changed! While this isn't a complete picture (ignores investment and other misc income) it does give a pretty good indication on how we are doing today in terms of what we spend or retain from what we are earning.

Even though my net pay is up significantly ($4k vs ~$5k) since 2008, it doesn't mean my actually earnings went up anything close to that. We have eliminated our ESPP contributions among other things (such as tweaks to 401k contributions, tax witholdings, flexible spending accts etc) to increase our monthly net pay.

A surprise to me is our monthly food bill - we are eating out very little and am surprised its so high. It might partially be explained that we often shop as SuperTarget for our groceries so as a result we may have non-food items in our bill, but to me this should be <$600 a month.

Utilities are more than I expected. We have moved into a bigger house at the end of 2008 and our utilities have gone up, but we don't have a home telephone, cable, or trash service. Today we only have 2 cell phones, gas, electric, and cable internet.

Gifts is are as expected - I believe we average about $100/mo in gifts for all types of occasions - kids birthdays, family, weddings, holidays. I think this is the new norm for us.

The $661 for Vacation/Travel was our purchase of our first cruise.The rest of the monthly expenses seem roughly inline with our new norm.

Without my wife's variable income we are basically spending what we are making. A far cry from our previous DINK status and we are reaping the reward from planning ahead and focusing on building our net worth in previous years. Now that we are a single income family we are relying much more on putting our net worth to work to continue towards our goal to financial freedom as we no longer have the ability to save like we use to.

Related in Cash Flow Money Management:

August 2014 Cash Flow (Sep 05, 2014) Well its been nearly 2 years since I sat down and did a scrub of our monthly cash flow. I use to do this regularly w/ MS Money, but now I find it painful to do. Its a lot more...

November 2012 Cash Flow (Dec 03, 2012) Its been 2 years since I last showed a snapshot of our monthly cash flow. I've realized some things have changed with our growing family and over the past couple years I've put a focus on improving our cash flow...

Reducing Financial Impacts of a Job Loss (Jan 26, 2012) My wife was recently notified that the preschool she teaches at for a few hours a week is shutting down. It got us thinking about a more difficult scenario for us - the loss of my job. Given its by...

Comments (10)

Hi 2Mil - may I ask where Your cell phone expenses are? I'm about to buy a house, make little less than you and considering a home about 250-280k and don't understand how you got your 300k loan to be 1500 a month?

Posted by Rick | June 23, 2010 11:32 PM

Rick,

Cellphones expenses typically run about $53/month. My why has a prepaid plan @ $16/mo and mine is remainder.

As for our mortgage - we bought a $300k, put 20% down, and our monthly principal + interest is around $1280. Our escrow for real estate taxes+ insurance is a little over $200/mo. Hope that helps.

Posted by 2million | June 24, 2010 8:22 AM

My wife and I always notice that our food costs are very high, and we limit dining out to once a month. We shopped at Target for a while, but now shop at a local supermarket chain and our costs have dropped. We've saved by buying the off brands, bagged cereals, dented cans, and taking advantage of cardholder sales.

Posted by Marshall Johns | June 24, 2010 2:37 PM

Hi 2M,

Should your Roth & 529 part of your saving?

Just curious what kind of work that your wife does at home? $700/mo seems quite high for a stay home mom. My wife also a stay home mom, and sometimes she sells stuff on ebay. She earns about $150/mo. It's few hundreds higher during holiday season.

Posted by james | June 24, 2010 2:51 PM

I don't know if this is true in a your cases, but some families tend to lose money when buying groceries in bulk. It does seem like you woud save money when you buy more of a product, but how much of it are you actually going to use?

If you have a rather big family then I suppose it is probably best to buy in bulk. Otherwise, food tends to spoil and go to waste (I've learned this the hard way like quite a lot of others).

All in all, it seems like you are getting a good portion of your income into savings, which is always a good sign.

Posted by heaps! | June 24, 2010 10:49 PM

2million's cash flow statement is after tax and after paying for 401(k), ESPP. I think the cash flow is pretty good compared to my own. The fact that he doesn't have to pay for child care helps.

Posted by finnews | June 27, 2010 7:01 PM

I would say your food costs are quite high. Mine run at $375/month for 3 of us plus a 100 pound dog (includes household stuff like you would buy at a super-Walmart). We also spend about $100/month on average eating out. Also I'm in Canada and I find groceries to be about 30% higher in Canada than the US. I think I've read that the average food costs in the US are about $580 for a family of 4 which seems about right.

Posted by Single Mom Rich Mom | June 28, 2010 10:29 PM

I enjoy shopping at target, but their prices can be a little steep in comparison to the local grocery store. Not to mention a place like that has everything "you need" even when you don't need it!

Posted by Tiffany | June 30, 2010 12:09 PM

how did that cruise with carnival go? my wife is trying to talk her parents out of going with carnival (reputation for being a college party ship) and booking with a ship more appropriate for old people. please let us know your experience. thanks.

Posted by Mike | July 1, 2010 7:00 PM

Mike,

Our Carnival cruise is scheduled for October. I'll let you know how it goes - we went ahead and paid for it when we purchased it.

Posted by 2million | July 1, 2010 7:11 PM