Update on Net Worth Growth

I've been struggling with a mental block over the past year that we are in a funk. Part of it is career frustrations, part I think a loss of focus, and I think part is a sense that we are not on the right trajectory for our financial goals. After all, we are only nine years away from 2021, where we set a goal to be financially free with a net worth of $2 million.

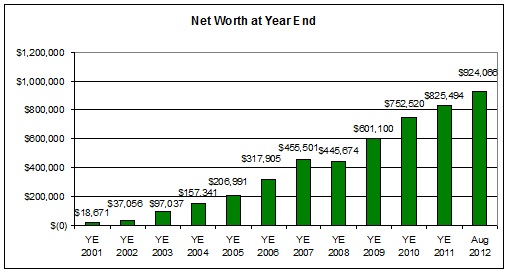

The funny part is I feel like we haven't been making progress growing our net worth over the past year - I think that has to do with in large part the stock market slump earlier in the year. With the monthly investment reporting that I do, I probably need to step back periodically and look a the bigger picture to get a clear sense of how things are going. To help get out of this funk I figured it would be good to get an updated view of our net worth grow:

Also see our 2011 net worth review

Looking at this chart I don't have a lot to complain about - we are clearly headed in the right direction and making regular progress. However it helped me see that our net worth grow is becoming more linear and less exponential. That makes a lot of sense as our expenses are clearly increasing with lifestyle inflation and a growing family. Likewise my job income has nearly flatlined and I haven't seen a raise >= 5% since 2008. My career plateau is probably where more of my sense of frustration is coming from.

Somedays I think it would be great to just walk away from the current career and start plugging away at my personal goals/projects like this site and others. Then I look at the income gap that would be left from my current job and I grimace as I know I'm stuck in the rate race for quite a bit longer.

Related in Net Worth:

July 2018 Net Worth Update (+$52,101) (Aug 03, 2018) Highlights for JulyI come out of July feeling optimistic all the way around. We had positive developments on numerous fronts including the bottom line.In July we purchased our 5th rental property! The property market is very hot around our...

June 2018 Net Worth Update (+$22,779) (Jul 08, 2018) Highlights for JuneIn June our activity picked up a bit and we closed with another solid month in the books.Our largest individual stock holding (Genworth) had a breakout month as the US govt (CFUIS) approved the deal for it...

May 2018 Net Worth Update ($20,481) (Jul 04, 2018) Highlights for MayIn May we closed on some long term financing (5.375% 30 yr fixed) for our rentals that we used to pay off our equity line and reloaded our cash for the next acquisition. Ive started looking for...

Comments (4)

What do you track your net worth with? Any certain programs you use to help you with this? You have information since 2001. That's great and i would like to start doing that as well.

Posted by Mat | September 19, 2012 12:01 PM

Mat, I used MS Money from 2001-2009 and since then have used Mint.com as an aggregator. Not great but the best I could find. I generate some reports in Excel for the monthly net worth snapshots I post in this site.

Posted by 2million | September 19, 2012 3:33 PM

FWIW, I'm quite impressed with what you've accomplished. I was actually looking at some of your Net Worth reports the other day to try to see what was contributing the most to your NW growth month-to-month to gain insights on my own plans. If it's stock market appreciation/dividends, then your NW growth will probably track the stock market index (NASDAQ, S&P, Wilshire) that most looks your portfolio.

You might consider adding a set of rows to your reports that split your NW growth by activity. For example, you retire significant debt each month on your mortgages. So "Debt retirement" is a category for NW growth. Stock value change and income investments (dividends) could be their own categories. So could real estate rents. You'd also need to figure out how to represent salary available for savings at the end of each month.

But reading a few of your reports it looks like your key contributor is you guys earn much more than you spend, and put a lot of it away each month. (which is not surprising at your NW level)

If it turns out your rentals are driving NW growth, maybe you should buy 1-2 more and negotiate a deal with a management company to manage multiple properties?

Posted by Greenbackradar | September 19, 2012 11:51 PM

Can definitely relate on the career plateau. Through my twenties and even into my early thirties my salary kept climbing, but has since flatlined. In order to experience any further increases in my current profession would require making certain lifestyle tradeoffs (i.e., much less work / life balance) in route to a management-track position. Although this has certainly left me feeling stagnant with my career, I've used it as an opportunity to focus on other, more neglected areas of life (e.g., friends, family, non-income producing hobbies).

Posted by woody | September 22, 2012 3:16 PM