My Personal Finance History

Based on requests, I thought I would give you more information about my personal history. My life's choices has a lot to with my journey to financial freedom so I think its important to know more of my background to better understand how I got to where I am today.

I graduated with a BS degree in Computer Science in December 1998. I was just like any other college student, broke, but I was blessed enough to have the support of my parents to pay for my tuition and basic living expenses while I worked to get my degree.

Rather than entering the workforce like most of my graduating peers, I opted to stay and get a MS degree in Engineering. I was luckily offered an assistantship at the university which gave me free tuition and a stipend (roughly $12,000 a year). I was again blessed to have my parents agree to continue to pay my health insurance premiums during this time.

While in graduate school, I purchased my first car, a newly used Nissan Sentra. I put $5,000 down (my life's savings) and I received a loan from my parents to pay for the remaining amount (roughly $7,000).

In addition, while I was in graduate school, I started a dot com business with my brother. We spent several years and roughly invested $8k of my savings in the business which we finally shutdown and sold off most of our assets in 2004 for a sizable loss.

In August 2001, I finally entered the real world and have been working at IBM ever since. I began paying close attention to my finances after reading The Millionaire Next Door

Since 2001, I have made steady progress in my increasing my net worth. I paid off the car loan from my parents and purchased my 1st house in 2002. In 2005, I rented out my house and and bought a 2nd house in 2006. In 2007 I rented out my 2nd house, took an international assignment in China, and finally married my longtime girlfriend. Once we get back to the US in 2008, we will begin looking for a new home.

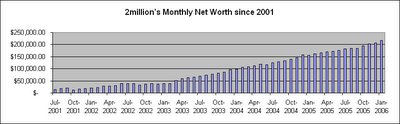

Here is a chart of my monthly net worth since I started working in 2001:

I left graduate school with a signing bonus and moving allowance that accounted for the majority of my $14k net worth in July 2001. As you can see I have been steadily improving this number to a more reasonable net worth today. Hopefully this streak will continue for many years to come.

Updated: December 2007

Related in General:

Save Money on Overhead Garage Storage (Aug 28, 2012) With the upcoming expansion of our family, my wife and I have been discussing the space in our home. While we have a good size home (~2,600 sq ft), its currently laid out with 3 bedrooms and 1 bonus room...

When is a SmartPhone the Right Financial Decision? (May 14, 2012) I last purchased a typical cell phone back in October 2008 with a 2 year contract when we returned from China. My old cell phone broke while we were on assignment in China and I needed something once we...

Black Friday Shopping Highlights (Nov 27, 2011) I have little interest in going out and standing in long lines to pick up a few deals on Black Friday. However we did pick up a few deals over the weekend mostly online: $159 GE Front Loading Washer @...

Comments (15)

DATE: 1:49 PM

Thanks for the additional info. I know it probably often seems like you have a long way to go, but I'm only a few years older than you and can confidently say that you are way ahead of most of your peers. Good work and good luck!

Posted by Cathy | September 10, 2006 3:17 PM

DATE: 3:56 PM

Great story and good luck for a great future .. A regular reader

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 8:52 PM

Just keep in mind that keeping your current marital status unchnged will be crucial for you to stay on the track to your goal ;-)))When do you think you gonna reach it?

Posted by crawlspace | September 10, 2006 3:17 PM

DATE: 9:26 PM

I'm in trouble then, it doesn't look like it will stay that way for long enough ;-).

Posted by 2million | September 10, 2006 3:17 PM

DATE: 9:04 AM

2million, you are doing the right things to reach your goal. Mortgage a huge expense for everyone. It is not an issue for you.finguyhttp://finnews.blogspot.com

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 4:29 PM

nice nice I am graduating in engeering also. I have a 12 an hour job currently full time both job/school.I am at 7500 currently but I am 20 years oldWnat to race to see who gets to the goal first? ahahah

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 6:42 PM

Hey I just created a profile I was the person who posted the last post just to let yall know a little about me

Posted by pyroracing85 | September 10, 2006 3:17 PM

DATE: 10:53 PM

extrapolating from your data, you'll reach your goal in 15 years assuming nothing dramatic changes.

Posted by Victor | September 10, 2006 3:17 PM

DATE: 4:37 PM

how much do you make per year?

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 5:27 PM

Getting married does not have to derail your journey. Hopefully the person you will be marrying has a similar philosophy about money matters. If not there are likely to be problems. If you do get married are you going to change your goal to 4 million? Kids are where the expenses come in. In addition to food, diapers, clothing, and day care there is saving for college. Navigating the world of 529s is even more complex than 401ks!My husband (43) and I (35) now have two kids (2.5 and 5 months). We have many of the same investment strategies you do and currently have a net worth of $840,000 ($460,000 in home equity and $380,000 in cash, stocks, etc.).

Posted by J | September 10, 2006 3:17 PM

DATE: 4:10 PM

you're doing really well. i'm 34 and have net worth of $469k with $190k of it in 2 paid off houses (1 is a rental, i live in the other one), rest in cash/investments. i'm in charlotte, where the housing market is BOOMING, mcmansions everywhere, tempting to buy more for appreciations sake (as opposed to rental income) but not sure i want to stay in the area. how's the market in raleigh? regarding marriage. . LOL . .my buddy emailed me www.nomarriage.com . . worth reading but if that's where you wanna go, then you'll go. the rules have changed since our parents time hate to admit it. but then again, there's more to life than $ or so they tell me ha!! UNLESS you/your fiancee are financial equals which i'm guessing you're not (dunno just a gut feel, we're not a dime /dozen don't think) may want to consider a prenup. love's great until the courts/lawyers get involved from what i hear. your friend,BDps. hsbc's great, then emigrant, then ing BUT you feel safe putting in over $100k? how much have you made in the market vs. equity investments?

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 3:02 PM

What did you do differently starting at the beginning of 2003? In your Net worth graph it is obvious that your uptrend started in 2003.

Posted by Anonymous | September 10, 2006 3:17 PM

DATE: 2:26 PM

Intersting observation. I actually believe it started in August 2001 when I started working full time for IBM. You'll notice my net worth peaks around July 2002 and then doesn't really recover until around March 2003 at which time things started steadily improving.My guess is that has a lot to do with buying my house in July 2002. I think all the expenses of a new home, moving, repairs, essentials, etc took its toll. Not to mention that my stock portfolio started to rebound in this same time period as well if I recall correctly.I think its pretty telling of the typical costs of home ownership.

Posted by 2million | September 10, 2006 3:17 PM

I'm confused by these numbers.

If you had $50K net worth in Mar '03 and then over 350K as of Apr '07.

With $4K/mth savings, you would need a compound rate of return of ~14% a year (after taxes).

With $3K/mth savings, you would need a compound rate of return of ~21% (again after taxes)

Now maybe you were able to save $4K/month ($48K year), or $3K ($36K year) for 4 years, but I have a feeling you weren't.

Posted by Skeptical | May 24, 2007 11:39 AM

Yes -- when you put it like that it sounds real good. However, take a look at my monthly net worth statements that have been posted on this site for the past 2years -- I have consistenly shown monthly growth higher than the numbers you are stating. I would say its safe to say that I was able to grow my net worth $3-6k/month since I started working.

I have lived well below my means; I invested most of my savings; I got alot of company benefits that help boost my ability to save -- such as 401(k) match, etc.

Posted by 2million | May 24, 2007 1:58 PM