Where Are We In Our Journey To Financial Freedom?

This blog was started back in 2005 to track my journey to financial freedom. I set out with a very specific goal and a measuring stick to track my/our progress. Given the the major recession we look to be recovering from are we still on track to reach our goals?

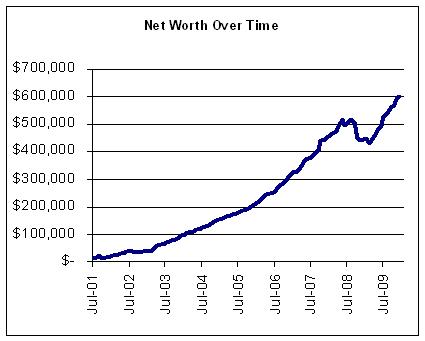

Here is a graph of my/our monthly net worth since I began tracking it in 2001:

The graph is pretty uplifting. It shows strong nearly exponential grow of our net worth with a significant blip in 2008/early 2009, but a quick and strong recovery (at least so far). Everything we are doing seems to be working overall. Of course I expect the curve to slow significantly down with all the recent changes in our family (house, baby, 1 income).

Back in 2005 I also created a measuring stick so we would know how we are fairing against our long term financial goal. Here is how we are doing:

| Net Worth Target | Year | Age | EOY Result 12/31 |

| | | | |

| $21,000 | 2001 | 25 | |

| $45,360 | 2002 | 26 | $ 44,000.00 |

| $73,492 | 2003 | 27 | $ 88,000.00 |

| $105,852 | 2004 | 28 | $ 155,736.61 |

| $142,949 | 2005 | 29 | $ 206,900.00 |

| $185,347 | 2006 | 30 | $ 317,904.00 |

| $233,671 | 2007 | 31 | $ 455,500.00 |

| $288,614 | 2008 | 32 | $ 445,673.00 |

| $350,946 | 2009 | 33 | $ 601,100.00 |

| $421,520 | 2010 | 34 | |

| $501,280 | 2011 | 35 | |

| $591,272 | 2012 | 36 | |

| $692,655 | 2013 | 37 | |

| $806,712 | 2014 | 38 | |

| $934,862 | 2015 | 39 | |

| $1,078,676 | 2016 | 40 | |

| $1,239,891 | 2017 | 41 | |

| $1,420,429 | 2018 | 42 | |

| $1,622,413 | 2019 | 43 | |

| $1,848,191 | 2020 | 44 | |

| $1,848,191 | | | |

We are still well ahead of the measuring stick. Ofcourse the measuring stick is very skewed on the last couple years and very dependant on strong investment returns for those years. However its purpose is to tell us whether we are on track and currently we feel pretty comfortable that we are.

Related in Financial Goals:

Financial Freedom Plan - 2015 Update (Apr 30, 2015) I finally sat down to get an updated view of our progress towards our financial freedom plan that I laid out a few years go in terms of asset allocation. Some notes: Our asset allocation to fixed income (interest) will...

Financial Freedom Plan (Aug 25, 2013) Almost two years ago I laid out a plan for the net asset allocation I thought we needed for our financial freedom plan. It was a rough guide for asset allocation that I believe could generate enough income to cover...

2012 Passive Income: Dividends (Jan 27, 2013) Here is a summary of our 2012 dividend income. All this income comes from our taxable stock portfolio that is included in our monthly investment review. All retirement investment holdings are excluded from this dividend income summary. This passive income...

Comments (5)

2million - I really enjoy your blog. Thanks for posting this overview. I'm not as young as you but am also targeting the same goal. Your overview was really helpful.

Posted by Another IBMer | January 6, 2010 2:33 PM

can you please share the excel for forecasting your networth? Thanks.

Posted by unimax | January 6, 2010 6:02 PM

Congratulations, you appear to be doing something right. I will have to read more of your blog to find out what you are doing to be so successful. Good Job!

Posted by Steven R Dison | January 6, 2010 11:37 PM

Great job! You've exceeded so many of your monthly net worth goals. What's your secret?

Posted by Joe | January 7, 2010 2:13 AM

Great progress indeed!! Congratulations! I was just looking at my own graph for the past 5 years.....I think ours look very similar; especially the "blip" from the market downturn and the recovery that followed. Keep up the great work!

Posted by Ryan | January 7, 2010 6:14 PM