Financial Freedom Plan

Almost two years ago I laid out a plan for the net asset allocation I thought we needed for our financial freedom plan. It was a rough guide for asset allocation that I believe could generate enough income to cover our living expenses when we are financially free.

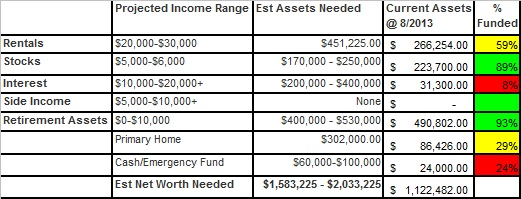

Overall our assets have grown by close to 50% from ~$750,000 to $1.1 million in those 2 years. Given our progress I wanted to see how our allocation was lining up. The table below compares our plan and current asset allocation:

A couple observations I have after staring at this:

- If we really are planning to walk away from our full time job income with about $2 million in assets then we need to be shifting gears. Our retirement assets (401k, Roth IRAs, etc) are basically fully allocated. Assuming positive returns continue over the long run I should be focusing more of our savings elsewhere. If we are not walking away once we hit $2 million it probably makes sense to continue to maximize retirement contributions due to their tax efficiency.

- Interest/bonds are the biggest gap we have. I even cheated a bit as about $30k is the cash balance of my pension plan so it should really be listed under retirement assets. The low interest rate environment has basically made investing significant amounts of our savings in this space uncompelling for the time being. However prospects of higher interest rates in the future are emerging. For now we are trying to focus on cash growth so that we can invest heavily here when the time is right.

- Cash - I'm disappointed we haven't been able to grow our cash at a faster rate. We have put a lot of focus on growing our cash, but we continue to have opportunities to deploy our cash. Over the past year we paid $30k+ in principal in our primary mortgage so we could refinance to a 3.5% 30yr fixed mortgage. We also had some unexpected major repairs including replacing 2 HVACs systems for $8k (one at our primary residence and one at a rental). We spent a significant amount of our savings transitioning our family to China for my work assignment. I also anticipate replacing my car in the next 24 months.

- Debt Paydown - We have a remaining mortgage balance of $210k on our primary residence, and about $185k in mortgage balances across our rental properties. We will continue to reduce our debt in moderation and would like to be in a position to payoff the majority of it by the time we walk away from any full time job income.

Overall we are in pretty decent position, and I'm excited to see the progress. Our financial freedom plan doesn't seem so far off anymore although we still probably have 7-10yrs to go. Going forward growing our cash position has to be a higher focus for us. The cash will allow us to take advantage of investment opportunities that will come up and handle unexpected events. I'm thinking I may consider ratcheting down our 401k contributions slightly (currently maximized) and redirecting some of those contributions to growing our cash.

Related in Financial Goals:

Financial Freedom Plan - 2015 Update (Apr 30, 2015) I finally sat down to get an updated view of our progress towards our financial freedom plan that I laid out a few years go in terms of asset allocation. Some notes: Our asset allocation to fixed income (interest) will...

2012 Passive Income: Dividends (Jan 27, 2013) Here is a summary of our 2012 dividend income. All this income comes from our taxable stock portfolio that is included in our monthly investment review. All retirement investment holdings are excluded from this dividend income summary. This passive income...

Can We Coast to Our Financial Goals? (Nov 12, 2012) As I continue to reflect on getting closeer to reaching our millionaire net worth milestone, I am becoming more optimistic and excited about what the future holds. I've pondered whether we could just tread water at this point and still...

Comments (11)

2Mil,

The retirement savings are stunning and a clear outlier. Have you analyzed how you got there? For example I started my latest job five years ago. Since then I have contributed X. My employer has matched 0.33*X (including 401K match + profit sharing), and capital growth has been 0.32*X. The IRR in my account has been 14-15%. During 2009 401K employer match and profit sharing were stopped (e.g. zero).

I do not anticipate IRR of 14-15% on the funds going forward.

BR

Posted by BR | August 25, 2013 1:08 PM

Amazing what hard work and focusing on a goal can achieve.

Would you say the first million was the hardest or is the second proving to be harder? We're well on our way to cracking the 6 figure threshold (maybe next year) and have set a $1.2 million goal for ourselves (1.2 Million Blog doesn't sound as good though).

We continue to find opportunities as well to invest our cash (stock market crash, SDP for deployed military, Lending Club, etc) and are perennially short on cash assets. However, with interest rates so low on cash-like assets, it's worth it right now to stay invested in higher yield stuff.

Posted by Spencer | August 25, 2013 5:28 PM

Just found your blog and I'm enjoying reading about your journey. You have an aggressive goal but it looks like you're making good headway! Very impressive.

Posted by FI Pilgrim | August 25, 2013 10:22 PM

BR,

Good question on retirement assets. I believe its an outlier because much of our free cash has been focused on maximizing retirement contributions due to their tax efficiency. Probably worthy of a post to document our contributions, growth though.

Spencer, Absolutely I've touched on this before - the first $250k was probably the hardest. It takes dedication and sacrifice to save a high % of your income. Once you have something to work with I believe its now more a matter of yielding higher investment returns.

Posted by 2million | August 26, 2013 2:06 AM

2mill:

those numbers sure look impressive. that said, if i were in your shoes, i would continue with the status quo. nothing wrong in overloading the retirement assets.

"It takes dedication and sacrifice to save a high % of your income."

also, the higher the income, the easier it is to save a higher fraction of it.

- s.b.

Posted by some body | August 26, 2013 11:25 AM

Too much property. Property is the easiest thing to increase taxes on.

Posted by dave | August 28, 2013 4:15 AM

Wow, great timing of this post. I've been spending the past month analyzing our own savings.....and I keep coming to the conclusion that we have fully saved for retirement. And like you, I was surprised to even be in that position so early in my career.

Since starting work, I've always maxed out 401K and Roth IRAs for both my wife and I. With the market performance the past couple years, it really propelled us forward. Sitting on $520,000 in those accounts.

Now I'm worried that our non-retirement accounts are too low. We paid off our primary residence 2 years ago and then 1 of our rentals last year. It's been nice to have been able to use the freed up mortgage payment each month for other purposes in the budget. Although, after having a child, some of the added costs took away slightly from the freed up payments. We're actively working on paying off the mortgages on our remaining rental and then I hope to shift a big portion to cash/stock savings.

Just last week, I made the TOUGH decision to dial back our 401K savings rate and I expect to slow down our Roth IRA contributions now too. I had to run a prelim tax return just to see the effects of it all. It will affect our ability to claim the child tax credit.

Anyway, just wanted to share because I was in awe that I was thinking about the same things as you the past weeks and month. Your post was very timely. Also --- I really liked the format of your table up above. It helps to keep the end goal in focus, to see what it will take in each of those areas to achieve the goal. And to assign a percentage completion rate to it all....brilliant. I'm going to do to the same right now to see how my stuff stacks up. Keep up the good work!!

-Ryan

Posted by Ryan | August 29, 2013 1:23 AM

Dave, Fair point, but if taxes go up my fingers are crossed that I can offset with higher rental income.

Ryan, Thanks for the comment - Im still going back and forth on maximizing the 401k contributions. I did ratchet it down a small percentage. However I did just review of our 2012 tax returns and squirmed a bit at the impact of losing more of the child tax credit, etc. If I knew our actual income for the next 10 years this would be easier to plan for. For now I am going to just shoot for somewhere in the middle. I'll reduce my 401k contributions slightly to increase cash, but still lean to over-allocate 401k contributions.

Posted by 2million | August 30, 2013 3:43 AM

Just stumbled across your blog - its great.

Nice to see someone discussing asset allocation properly so many sites are fixated with either property rentals or index trackers.

Will be back.

Posted by Mike | September 2, 2013 4:47 PM

Don't forget that Roth contributions can always double as cash/emergency fund in an emergency. Also, 72(t) gives you some flexibility to get retirement funds out early w/o penalty. In short, I wouldn't worry too much about being relatively so much ahead in retirement versus the other categories.

Posted by Bob | September 6, 2013 1:35 AM

Thanks for sharing your progress towards your goals. It looks like you're a few years further down the road than we are, and making some great progress.

It's hard to shake the tax shelter attraction that is drilled into us by the financial community. There are certainly benefits to allowing your investments to grow tax free, but you pay a steep price to have to lock your assets down for so long. I'd rather have them out where I can use them in investing in property, businesses, etc. without having to worry about dodges like self directed IRAs.

Posted by Jack @ Enwealthen | September 21, 2013 7:03 PM